We got this letter from a reader:

Stocky,

Sadly my father passed away, but he had a $200,000 life insurance policy. My mom spent $60,000 as a down payment on a house and $40,000 for my sister’s medical school. That leaves $100,000 left; I was thinking about going into business with a couple shady guys to start a liquor store, but my wife talked some sense into me. So we decided to invest the money in an S&P500 index fund (VFINX).

My question to you is, should we invest the $100,000 all at once or spread it out in smaller investments over a couple months?

Walter Y from Chicago, IL

I admit I may have made this letter up as a framing device, but Walter’s problem is a pretty common one. Maybe it’s an insurance payout, a tax refund in April, a bonus check, or a bunch of cash you’ve accumulated in your checking account. In fact, every July the Fox family faces this exact scenario when I get my bonus check. Let me tell you my thoughts on the matter (which of course is not an expert opinion, and which looks at historical price movements but makes no prediction on future stock movements).

When I get my bonus, and what I would have suggested to Walter, is to take the big chunk of money and invest it in equal pieces over a couple months. Vanguard and most places will let you set up an automatic investment, so in the words of Ron Popeil “you can set it and forget it.” So let’s imagine for Walter he would invest $10,000 per week into his mutual fund for the next 10 weeks. Why do I do it this way? Because I’m a spaz.

If I invested all the money at once, I would be totally freaked out that I would buy at the wrong time—either I would buy the day after stocks went up 1% or I would buy the day before stocks dropped 1%. Using Walter’s scenario of $100,000 to invest, that would mean I could “lose” $1000 by investing at the wrong time. That would totally tie me up in knots and I would be looking at the stock market trying to find the exact right time to jump in, like a kid on the playground playing jump-rope. Of course we know from A Random Walk Down Wall Street, that all that stuff is random so there’s no point trying to time it, but I’m not totally rational when dealing with that much money.

For the blog, I did a little analysis and found that 12% of the time stocks* lose at least 1% in a single day; if I bought the day before that happened, I’m out at least $1000. On the other side, about 13% of the time stocks rise 1% or more in a day; if I bought the day after that I’d similarly be out $1000.

My fragile nerves just can’t take that so I want to “diversify” the timing of my purchases to even out those big ups and big downs. This is a strategy called “dollar cost averaging”. So as I said, initially I would have recommended to Walter that he take the cautious path, take his $100,000 and split it into $10,000 chunks, and invest those each week for the next 10 weeks.

But then using the magic of spreadsheets and the internet, I decided to see what the actual data said. I looked at every week for the market since 1950 and did a comparison of the two scenarios:

- Invest your entire chunk of money all at once

- Spread your investment evenly over 10 weeks (dollar cost averaging)

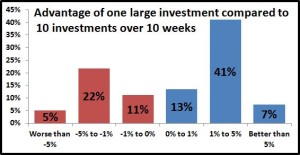

Wouldn’t you know that on average it’s better to invest your entire chunk at once? I’ve been doing it wrong this whole time, so thank you Stocky Fox. In fact it’s not even close—historically it has been better to do option #1 about 61% of the time.

The thinking is that historically, stocks have always gone up. Sure there have been some rough patches, some of which can last a really long time, but the general trend is definitely upwards. So if you wait to invest your money over a longer time period, you’re missing out on some of that upward trend. I looked at every week since 1950 (if you were curious, there are about 3400 weeks) and on average you gain about 0.7% by going with option #1 instead of option #2. 0.7%!!! Holy cow. Remember that post on The power of a single percentage? We just found a 1% coupon right there.

So Walter, my advice is to pick a day this week and invest it all in one fell swoop. You might get hit with bad luck, but the odds are better that you’ll get hit with good luck to the tune of about 0.7% (which in your case is about $700). On the day you do it, don’t even look at the stock market and have several tablets of Alka Seltzer on hand.

*For this analysis I am using the S&P 500 data going back to 1950.

One thought to “How to invest a windfall”