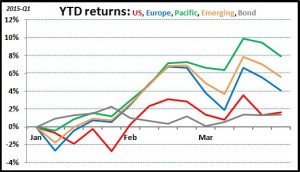

We just got through the first quarter of 2015. And as it turned out, it was a pretty good quarter to be an investor, especially if you had diversified your portfolio to include international stocks. Pacific stocks led the way up 8%, followed by Emerging stocks up 6%, European stocks up 4%, and US stocks up 2%. Just for comparison, a bond mutual fund (VBMFX) was up about 1%. So all things considered, that was pretty good. What do these past three months tell us?

Things tend to balance themselves out:

Over these past three months, the markets have swung wildly up and down, but those swings tend to cancel each other out and you end up not that far from where you started. Let’s look at the US markets here—it was up about 2% for the quarter. During that time there were 63 trading days, and the Dow Jones Industrial Average was either up 100 points or down 100 points an astounding 36 times; that’s 57% of the time. Think of all those times when the market was down 100 points and everyone was talking about how terrible things were becoming. Think of all those times when the market was up 100 points and everyone was talking about how good things were. All those balanced out and the US market finished about 2% above where it started, despite those crazy swings.

Tragedies tend to not impact stock markets:

Very sadly, we’ve seen several tragedies in these three months. Terrorist attacks in France, Nigeria, Kenya, and other countries killed thousands. Wars in Yemen, Syria, and Ukraine have displaced millions and ground national economies to a halt. A demented pilot intentionally crashed an airplane, murdering 149 innocent passengers. Plus the “usual” natural disasters which killed people and destroyed property as always happens.

All these things capture the headlines for days at a time, yet they don’t really have a noticeable impact on the global economy. Cars and phone and t-shirts continue to be made. Oil and gold and wheat and cucumbers continue to be plucked from the earth. Lawyers continue to appear in court and doctors continue to treat patients. Those tragedies impact us emotionally but it doesn’t change how much we produce and how much we consume. In that way life goes on as usual. Of course, there are tragedies that have a major economic impact (World War II is probably the best example), but those aren’t very common; certainly none this quarter qualify.

Headlines have a short shelf-life:

In the 63 trading days this quarter, there’s probably been let’s say 100 major headlines. How many can you name? Sure, some of those tragedies might come to mind, but what about on some random day like Wednesday, January 21? The biggest national story of that day was the measles outbreak at Disneyland. Two months later, does that even matter? The aftermath provoked a nation-wide debate about immunization, but even the energy around that has died down as the nation’s attention moved on about 40 more times.

The Fed will change its mind a million times:

It seems every week there’s some event involving the US Federal Reserve. Either some report is coming out, Janet Yellen is making comments somewhere, minutes from some previous meeting is be released, or something else. The global financial industry hangs on every word trying to divine if that word means interest rates will rise or if that comment means they’ll stay flat.

In the past three months there have been no less than 10 days where markets moved up or down over 1%, largely driven by reactions to the Fed. Think about that though—it swings up or down almost weekly, but add them all up and you end up almost where you started.

You’ve probably noticed a trend, and this is really the point of me doing these weekly and quarterly reviews. For all the news that we’re constantly barraged with, most of it really doesn’t matter when it comes to investing. If you were Rip Van Winkle and were asleep for the past three months, you’d wake up and see your investments were up 2% in the US and more in international markets. From an investing perspective, would it have mattered that you missed those 100 headlines? Probably not.

I say all this as a reminder that investing is a long-term proposition. Everyday there will be plenty of “action” that gives talking heads and reporters fodder and makes the market “wiggle” but those effects only last until the next headline. Wise investors look past this and benefit from keeping their eye on the horizon.

On that note, have a very happy Easter tomorrow. Lil’ Fox has been talking incessantly about the Easter Bunny coming and bringing “candy eggs” all week.