I hope everyone had a great holiday season and a happy new year. For us, the cubs got too many gifts under the tree (note to self: next year, make Christmas less materialistic). I was the only one still up to ring in the new year, and I did that binge watching A Game of Thrones.

We made it through a pretty wild year for stocks. In no particular order, here are some of the major stories, events, decisions, and issues that drove the stock market:

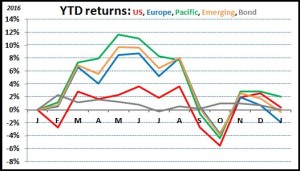

Down year for US stocks—This was the first year since 2008 that the US markets had a down year. That’s pretty good: a 6-year streak. And this year really wasn’t that bad. US stocks were down less than 1%, so I suppose if you are going to have a down year, this is the kind you’d like.

Of course, even though stocks ended the year very nearly where they started, it was a crazy ride in between. At one point, stocks were up for the year about 4%; a couple months later they had lost all those gains and then some, being down about 6% for the year. After all those zig-zags, they settled where they started. There’s probably a lesson there, that if you stay calm and look past the short-term craziness, these things tend to work out.

International stocks still struggle—International stocks had a much tougher year than did US stocks, being down about 2-4% (depending on how you define “international stocks”). As wild as the ride for US stocks was, it was even wilder for international stocks. They started out like a bat out of hell, gaining about 10% by the time summer came around, but just like their US counterparts, they swooned in the fall, losing all their gains and then another 4% or so. That’s pretty crazy, a 14% swing in a couple months.

Looking back on the major stories that drove that, to me there are two: Greece and China. The Greek epic (or should I call it tragedy?) continued with high-level brinksmanship rattling the markets as the deadline for their debt loomed. Sadly, the powers that be kicked the can down the road, giving Greece another short-term loan that will carry them for a couple years. Mark your calendar, we’ll do through this whole thing again in 2017.

China also rattled the market. After years of 8-12% economic growth, China’s economy has started to show some real signs of slowing down. In 2016 most experts are predicting something in the range of 6%. Make no mistake, that’s still a lot of growth, much higher than the US’s 2% or any other developed nation’s. But that’s a major pull back for China, and of course that directly translates to a lower market.

Finally, there was the horrible terrorist attacks in France. This was probably the biggest story of the year, so that’s why I mention it. However, as deplorable as they were, they pretty much had no impact on the stock market (they took place in November which was a mixed month for the markets). Sure, the days following the attacks the markets were a little shaky, but that wore off when people started to realize that companies would still produce products and people would still consume those products. I bring this up as a reminder that many of those events that are most troubling to us have little impact on the stock market.

Fed raises rates—After seven years of keeping interest rates at about 0%, in December the US Federal Reserve raised interest rates by a whopping 0.25%. A quarter percent really isn’t that much, but this was largely symbolic. During the 2008 financial crisis, the Fed dropped rates to that 0-ish% level, the lowest they had ever taken rates in history. I certainly look at this as good news, in that the Fed thinks that the US economy is strong enough to withstand higher interest rates without slowing growth or raising unemployment.

So that’s the year in a nut shell. When you take an entire year, and condense it to a few hundred words, I think it does put things in perspective, especially with the stock market. In 2015, there were probably over a billion words written on what was happening, what had just happened, and what would happen the next day. In the end, we had a flat year. To me this just shows how much energy and emotion gets put into this stuff which is largely wasted. You can just invest your money and then focus on other, more important things like if the Broncos can win the Super Bowl or if Jon Snow is really dead.

Finally, I would be remiss if I didn’t thank you readers for taking this journey with me. I am especially thankful to all those who left comments and helped me make this blog and fun and informative one.

Here’s to a great 2016. As to what I think will happen: I have no idea but I am fully invested.

I love your blog because with all the nutsy things happening in the world, I feel calmer after I’ve read it. This was a good overview of the year!