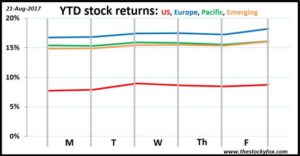

Yawn. What a boring week for the markets. There weren’t any meaningful headlines or blockbuster deals that dominated the financial media. Stocks just trudged along. At the end of the week we were up 1%, Europe was up a bit more and Pacific a bit less, but still up 1%!!! That’s really the perfect scenario, no?. Nothing too crazy happened, the companies just created value in anonymity, and investors were rewarded.

Of course, there were some stories. Here are the interesting ones that I think drove the market:

Data came out that home sales were slowing, particularly new home starts. This is a bit of a big deal in that homebuilding and construction are a fairly large part of our economy. If that slows that means fewer construction workers have jobs, less building material is being used, etc. That will impact earnings of companies.

Second, and maybe more important, is that new home builds tend to reflect overall confidence in the economy. Ultimately, these houses will be bought by someone almost certainly borrowing money with a mortgage. Those people need to be confident enough in their financial prospects to take that on. If that confidence is eroding which ultimately makes it to fewer houses being built that might portend the end of our pretty spectacular bull run. That’s not to say that will happen, but it might be an early hint.

Somewhat related, durable goods orders fell more than expected. Again it’s a similar calculus. Durable goods represent a long-term investment so if people are less confident that might be the cause. Stay tuned on this one.

US limits trade of Venezuelan bonds

What is going on in Venezuela is a tragedy. You may recall I did a post with a former classmate of mine looking at how investments are done in that country. At the time it seemed very pessimistic, but compared to now those probably seemed like the good ole days.

It’s so sad. The real tragedy is the humanitarian toll the Venezuelan government is imposing on its people. Kids are starving, people are going without medicine, simple products can’t be bought, and the currency is becoming tissue paper. So sad.

The US government imposing these new restrictions is obviously an attempt to break the current Venezuelan government and get something better, ideally capitalist, in there. It’s a long road but if that could happen a tremendous amount of investment would flood into the 32 million person country with the largest oil reserves in the world. Companies could make a lot of money capitalizing on those opportunities. Oh, and by the way, it would help all those millions get good jobs, fill their bellies, educate their kids, and get back to normal.

Amazon cuts Whole Foods prices

No week is complete without a story about Amazon changing the world. On Monday the merger with Whole Foods will be completed. Amazon made waves by saying they would drastically cut prices at the grocer. This definitely follows Amazon’s playbook by bring logistic excellence to their operations and passing the savings on to the consumers.

Some have complained this might start a price war with grocers. I say “bring it on.” Who loses there? Maybe grocery stores that haven’t invested in improving their operations so they can’t compete. Sorry about your luck, but you need to keep up. Who wins? We do. We get better service at lower prices. Amazon can definitely create tremendous value which makes them money and saves us money, which we can spend or invest in other things. All that’s good for the stock market.

It’s a long time before it would happen, and it’s far from certain that it would, but a debt ceiling showdown looks like it might be coming. These things are always high drama, and then always have a way of resolving themselves either right before the government would actually shutdown or shortly after it did.

A government shutdown has huge economic implications. Federal government spending is something like 20% of GDP so it’s a big deal. Last time this happened, during the Obama administration, stocks fell about 4% when the government shutdown. After it was quickly back up, stocks regained all that back.

Hope you all have a great weekend.