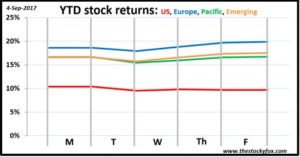

It’s been an up-and-down week. US stocks ended the week down 0.6%, Pacific stocks were pretty much flat (we’ll tell you why in a second), and European and Emerging stocks were up over 1.0%.

North Korea tests another nuclear bomb

Over the weekend, North Korea captured headlines with another bomb test. What made this different from previous tests was this bomb was much, much larger. North Korea’s previous tests were in the 10 kiloton range or lower; this one was at about 100 kilotons. That’s a far cry from 25 megaton nuclear bomb in the US’s arsenal, but it’s still troubling that North Korea is making steady advances both in nuclear and missile capabilities.

The news clearly rattled the markets. When trading opened on Monday (Tuesday for the US since Monday was Labor Day), stocks tumbled. Hardest hit was Pacific which makes since given the two biggest components there are Japan and South Korea.

Who really knows on this. This has the potential to be more sabre rattling and potentially a mortar shot or two that freaks everyone out before things return to normal. Or, it could start World War III between the US and China. Obviously, WWIII would devastate the stock market (think down by 50% over 10 years—ouch). There’s a lot of risk right now.

As Houston recovers from Harvey, Florida is bracing for Irma. Just like last week, this is a human story and my heart aches for all the people whose lives have been turned upside by these storms.

However, there is also a major economic and financial impact. It’s estimated that Harvey recovery will cost about $180 billion. Irma is expected to hit this weekend so we don’t know how bad that will be but a lot of people who think Irma could be worse than Harvey. Let’s hope not.

In dollars and cents, that means another 12-digit expense. Those things add up. The markets largely wrote off Harvey without a blink. I wonder if the US markets are down because another hurricane with the potential to do so much damage is coming. If the US needs to spend $400 billion in a recovery effort, that is a MAJOR component of GDP. It becomes significant.

Rockwell Collins bought for $23 billion

In a story that looks more like traditional business an investing fare, United Technologies announced its intention to buy Rockwell Collins for $23 billion. That is a big deal just because it’s a BIG DEAL. You know all the coverage and energy that surrounded that? It was a $14 billion deal. This one is almost twice as big.

Again, I always look at these types of mergers as a good thing. It shows confidence that things can be done better. United Technologies thinks they can create value, the lifeblood of the stock market, in the merger. They are putting their money where their mouth is by making spending $23 billion. It even has an instant impact given that before the merger was announced, Rockwell Collins was only valued at about $20 billion.

So just a simple view shows that they think there’s at least $3 billion in hidden value there. Probably more to make it worth their while. That’s the stuff of investing and business—companies seeing opportunities where they can make something better and more valuable than it was.

There you have it. It seems like a lot of uncertainty, both political and natural disaster-wise, has kept things a bit off balance. Everyone have a wonderful weekend.