The US has a complex tax code. That means people are always looking for ways (hopefully legal) to reduce the amount they owe in taxes.

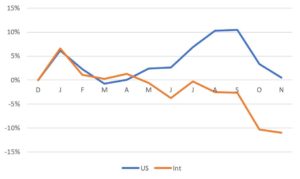

Tax loss harvesting is one way you can do just that. The option isn’t always available; you need to have investment losses which means you can only do it in years the market is down. Through November, US stocks were slightly down for the year while International stocks were down significantly. That created the situation where you might be able to do some harvesting.

There are some intricacies with the tax law here. Remember that I am not an expert, so if you do this, you may want to consult a tax professional.

What it is

We all know that when you make money in the stock market (sell stock for more than what you bought it for), you are taxed on that gain. That’s called a capital gain. The opposite is true for losses; when you have a loss (sell for less than what you bought it for), you can reduce your taxes. Wait for it . . . those are called capital losses.

Tax loss harvesting is selling some of your investments at a loss, and then using that capital loss to reduce what you owe to the government in taxes.

How to do it

The strategy is pretty simple. When markets are down you can sell some of your investments at a loss.

Then at the end of the year, you can claim that loss on your taxes. The loss will offset any stock gains you have (either capital gains or distributions/dividends). If you still have losses after those have been offset, you can reduce your taxable income by up to $3000. That last part is a pretty sweet deal, especially if you are in a higher tax bracket.

Tactically, you just go to the website with your accounts (www.vanguard.com or www.fidelity.com or where ever) and sell those investments which have a loss. The in April when you pay your taxes, you get the tax forms from your brokerage house, and put those in your tax forms. Easy.

Why it’s important

The major benefit is that you are reducing your tax bill . . . now. Notice how I said that. Ultimately, you’re doing all this to lower your tax bill now and have it increase at some point in the future. Make no mistake, at some point or another you will need to pay taxes on your gains, it’s just a matter of when.

Obviously, having more money now instead of giving it to the government is a good thing, even if you’ll have to give it up later. Beyond that, there is the potential to create real dollar savings instead of just delaying when you pay taxes.

Capital gains and qualified dividends are taxed at three different rates, depending on your income.

| Income (for married couple) | Tax rate |

| $0 to $77k | 0% |

| $77k to $600k | 15% |

| $600k+ | 20% |

If you can use tax loss harvesting to influence when you pay taxes on those capital gains, there is the potential to recognize them when you’re in a lower tax bracket.

For Foxy Lady and me, we are in that middle tax bracket, so we would pay 15% on any capital gains and qualified dividends. However, if we did harvesting now and then recognized those gains in a year when our income was lower (below that $77k threshold), it’s possible that we could lower our rate from 15% to 0%. That’s real savings.

Doesn’t that defeat the purpose of investing

When you tax loss harvest you’re selling your investments, obviously. That could lead to another problem that you’re pulling your money out of the market, and you’re pulling your money out when stocks are down which seems like the absolute worst time. Likely you don’t want to do that; certainly, all other things being equal, pulling your money out at a loss isn’t what we’re going for with investing.

Actually, you can just trade your investments. So you can sell mutual fund ABC at a loss and simultaneously use those proceeds to buy mutual fund XYZ. You get the benefit of the tax loss but stay in the market.

The IRS understands this and has rules. You can’t sell ABC, recognize the loss, and then immediately buy back ABC. You have to wait 30 days to do that round trip.

However, you can buy something similar. The IRS says it can’t be too similar, but they don’t strictly define that so it’s a gray area. I personally, think it’s fair game to sell a broad mutual fund and buy another that is similar but still different (maybe a total international mutual fund gets sold and a total world mutual fund gets bought). You are still fully invested and largely have similar exposure, but you get that tax loss which is the whole point.

I don’t think this is something that is going to make you rich (like asset allocation or lowering fees—those strategies will make you rich). But it could net you a couple hundred or maybe even a couple thousand dollars. Who says “no” to that?