I’m trying to build my audience, so if you like this post, please share it on social media using the buttons right above.

The insanity of the stock market’s reaction to coronavirus has prompted a few questions in the mailbox. Let’s see what we’ve got.

“Do you think this is a buying opportunity in the market or do you think there is a deeper drop to come?” BB from Greensboro, NC

Actually, the answer is “yes” to both. I do think this is a great buying opportunity, and I also do think there is probably a deeper drop coming.

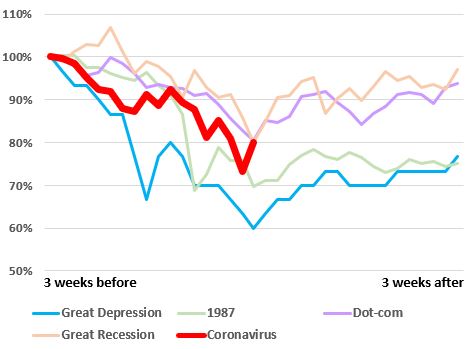

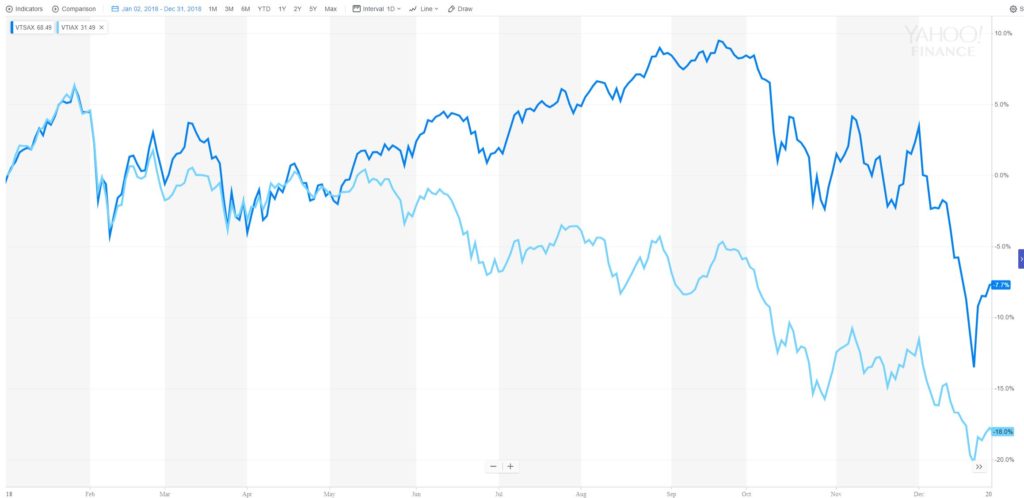

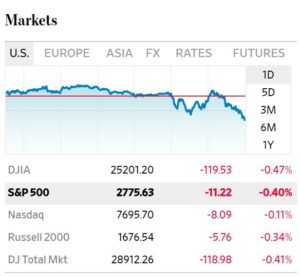

Long-term, the market is way overreacting. After yesterday’s bloodbath, stocks are down about 35% from their highs just a few weeks ago. That seems absurd. All the companies in the world didn’t lose over a third of their value over this.

Even if you look at the industries that are hardest hit, like cruise ships and airlines, it shouldn’t be that bad. Maybe they’ll be out of commission for a couple months, and that’s bad, but not 35% bad. Other industries shouldn’t be nearly that bad. Grocery stores should be doing just fine (better than fine given the rush to buy toilet paper and hand sanitizer). They’ll have a little bit of disruption while we work our way through this, but it should be fairly minimal. That’s all to say, I think things are way oversold and in a year or two we’ll look at this as an amazing buying opportunity.

However, in the here and now I don’t think we’re out of the woods. There’s so much still unknown, most importantly “when we’ll reach peak infection in the US”. That’s really the key to it all. South Korea reached peak infection after about two weeks while Italy still hasn’t reached peak infection after three weeks. Either way, the stock market will recover. If we look more like South Korea then we will recover nearly as quickly as it’s fallen. If we look more like Italy then we will fall considerably more before things turn around.

To directly answer the question, I would buy into stocks but not right now. I think things are going to get worse before they get better. There’s a famous saying in investing: “don’t try to catch a falling knife”. Basically, it means when a stock is falling, don’t try to time it perfectly. Rather wait until the stock “hits the floor” and things settle. Even if you miss the absolute bottom by a bit, you’ll still be able to get in when stocks are well off their highs.

That’s the approach I would take now. I would keep any cash handy and wait until we confirm we’ve hit peak infections. Once that happens, the stock market will probably rally 10% or so in a single day. You’ll miss out on that but you’ll still be able to get in at 20-30% less than what you would have gladly paid a month ago.

“Why is gold going down? With trillions of dollars reduction in equity, where is all the money going? Is it liquid, and will it come roaring back when the virus caused business slowdowns stop?” Uncle Bobcat from Ft Wayne, IN

Gold has been pretty interesting through this. It was steady to rising for most of the crisis and it was only in the past few days that it started a freefall similar to stocks.

The short answer is that gold has been falling because interest rates have been cut. Look at gold’s major falls on March 2 and again yesterday, and those coincide with when the Federal Reserve cut interest rates.

The longer and more interesting answer is that I don’t think it’s clear what role gold plays in this crisis. In 2009 everyone thought the world economies were going to collapse and fiat currency would become worthless paper. Hence, people were fleeing to gold as a store of value.

That doesn’t seem to apply here. I don’t think anyone feels the economy is going to collapse in some cataclysm. Rather, the economy is just taking a massive body blow. Things that were worth X before are now worth X less 20-30%. That goes for stocks for sure but then for a bit of everything else like shiny yellow metal.

With regard to your last question, I do think things are oversold and things will be better. As I said in the other question, everything revolves around when we hit peak infection. Once we hit peak infection, I think we’ll have a huge recovery.

That said, I don’t think we’ll get back to where we were before this all started, and that should make sense. A huge amount of value has been lost that we’ll never get back. Those idle cruise ships can never make up that time. Same applies to restaurants, conferences, sporting events (I know a part of Uncle Bobcat died when they cancelled the NCAA tournament). That value’s gone and can’t be recovered.

On the other hand, a lot of stuff can be made up. A lot of the supply chain problems caused by China not shipping stuff will be made up once the factories start humming again. Same thing with dentist visits, plumbing work, and other stuff like that.

Take all that into account and my sense is that within a year we’ll be at about 3-5% below where we were when all this stuff started.