What do you think of Cracker Barrel’s stock (CBRL)? I heard that aside from the food they sell each store sells something like $1 million in merchandise. Should I buy some?

— Doug from Detroit, Michigan

As a rule, I don’t invest in individual stocks because it seems like a lot of work to figure out which ones will make good investments. Instead I just invest in index mutual funds using dollar cost averaging, and that works well for us.

That said, if you look at Cracker Barrel there are a lot of reasons to like it as an investment. Over the past year it’s up about 40%–that is either a bad thing because maybe you missed out on the upside, or it could be a good thing because the stock is doing well and there’s no reason to think it won’t continue to. Who knows on that one?

If you look at the price to earnings ratio (P/E), it’s at 23 which means you’re paying $23 for each dollar of earnings Cracker Barrel makes. That’s definitely on the high side, so that might be another reason to be cautious.

Finally, if you look at the dividend, the stocks pays $4 per year which is about a 2.6% yield. That’s really good compared to most stocks. So in addition to enjoying any price appreciation that might happen, you’ll also be getting a yield higher than a 10-year US bond. Of course, Cracker Barrel might lower the dividend, so you need to beware.

Put that all together, and your answer is a firm “I’m not really sure”. There are a lot of things to like about Cracker Barrel, but you don’t really know if you missed the boat. In general I always recommend investing your money, be it in index mutual funds (my first preference) but if you want to pick individual stocks, Cracker Barrel seems just as good as any stock.

What do you think about the Fed’s policies and how a strong dollar will affect the U.S. economy and your investments?

— Andrey from Barcelona, Spain

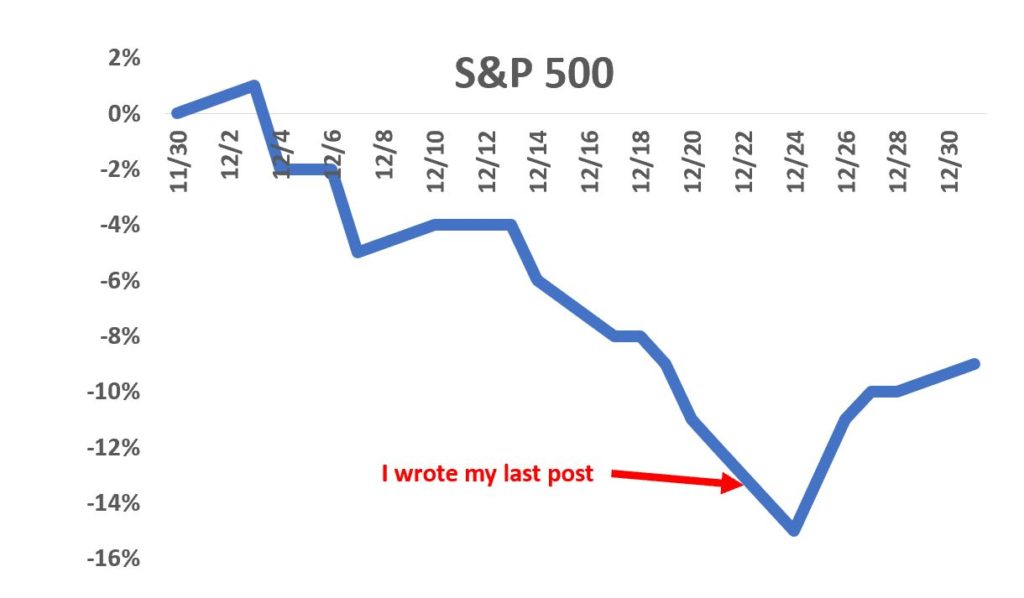

This has been getting a ton of news lately. I personally think it’s a good thing that interest rates will rise to more normal levels (we’re at almost 0% which is not a sustainable long-term level for interest rates).

The dollar has been strengthening a lot lately because many other countries are having economic problems. Europe is hampered by Greece (and potentially Spain and Italy) debt issues, Japan remains in a funk, China is slowing down, etc. The US economy is growing and inflation is low, so that makes the it a really attractive place to be, financially speaking. And that has the effect of the dollar increasing in value.

There’s always the concern that if your currency strengthens, then that will hurt your exports, and thus hurt your economy. This leads to the weird paradox that as your economy strengthens it leads to weakness. Maybe the stronger dollar will hurt imports some, but I think that will have a pretty negligible effect (remember that compared to domestic consumption, US exports are much smaller).

From an investing perspective, I think things will be fine. If your economy is strong and inflation is low, that’s generally a great formula for investments. The Fox family is fully invested in the market right now.

The day they announce interest rates are going up, stocks will probably fall a lot. But after that, people will start to get the concept that interest rates rose because things were looking so positive.

I have read several articles recently and they all talk about gold and diamonds. The price of gold and diamonds is bound to go up because the resource is limited. Stocky Fox, is it a good investment to buy gold via my bank?

— Harold from New York City, New York

In general, commodities like gold don’t tend to be a very good investment. Certainly over short periods of time, gold and other precious metals might do really well. But over the long-term, compared to stocks and bonds, commodities end up really underperforming stocks. Remember the difference—with stocks you’re giving money to a company so it can build a business that earns money, but with gold you’re just holding money in a bank that doesn’t do anything.

That said, gold is a good store of value, especially in uncertain times. In 2008 when the world thought the global financial system might collapse, gold did really well. In that way, I look at gold as a little bit of “insurance” for my portfolio. You want most of your portfolio in stocks and bonds that should produce returns, but maybe you keep a little bit in commodities as insurance in case the world goes to hell. The Fox family has about 5% of our portfolio in commodities.

A lot of people, especially in Moscow, are living off renting apartments that they got as an inheritance from their relatives. If you get an apartment from your grandma or aunt, getting $2000 to $4000 out of it each month is a sweet deal. Should I buy apartments in order to rent them out when I retire? How good is that investment?

— Ivan from Moscow, Russia

I had a post on rental properties. Overall, I think they make a lot of sense, so long as you can avoid the nightmare scenarios of having bad tenants. Given you’re in Russia where it’s more difficult to invest in stocks, that makes rental properties all the more attractive.

Like all investments, rental properties are only so good at the deal you get. If you pay a too much for the apartment it won’t be a good deal. If you can buy an apartment at a low price, then you’ll make out pretty well. As a rule of thumb, I would divide the annual rent by the cost of the apartment. If that is 8% or more, it’s probably a pretty good deal.

What do you think about investment firms like Betterment or Wealthfront?

— Noah from Chicago, Illinois

I think they make a lot of sense (Wealthfront is connected to mint.com and I use Mint, so I am barraged with pop-up ads from Wealthfront). My basic understanding is that they have taken investing and automated it using fancy-smanchy algorithms.

They invest your money in index mutual funds (just based on that, I’m a fan) and they have a pretty user-friendly interface so you can select the risk you want, diversification, etc. Then they automatically invest your money in the appropriate index mutual funds based on your choices.

The problem I have is that they charge you about 0.25% for all of this. That doesn’t seem like a lot ($250 annually for a $100,000 portfolio), but as we’ve said many times, that adds up. Over an investor’s career, that 0.25% could come to tens or hundreds of thousands of dollars. I personally feel that most people can do everything that Betterment or Wealthfront does on their own with Vanguard.

The only really innovative strategy that I noticed was that they do which might not be super-easy for an individual to do is “tax loss optimization”. Basically that means selling investments at a loss to offset the taxes you would owe on investment gains. But over the long-term, aren’t you supposed to have many more gains than loses? So I don’t think that will add a ton of value over the long run.

If you just want something simple, these sites might be really good and probably worth the money. However, I also think that what they do most people could easily do for themselves with a few hours of work per year.

Now that consumer electronics are so cheap, are they a good investment?

— Ally from Serbia

Consumer electronics are almost never a good investment for the very reason that they are so cheap and they become obsolete so quickly. One of the major problems I think you’d have is reselling them for a profit after you bought them.

Maybe you know a lot of people that would buy that stuff, but then that starts to sound a lot more like a job than an investment. But I would definitely avoid “investing” in consumer electronics.

I do not trust banks. I would rather keep my money in US dollars at my home. Is that a good investment? After all if I have $10K at my place and there is really low chance of apartment robberies in Moscow, I will have the same amount of money in 10 years, right?

— Katya from Moscow, Russia

The problem with keeping cash at home (other than robberies which you mentioned) is that you aren’t earning anything with the money. Remember that using historical averages stocks return about 6-8% annually. If you just hold cash, you’re missing out on that. Also, when you hold cash, inflation eats away at the value of those dollars. Over the past decade US inflation has been about 2%, so you’re losing that as well.

The answer to your question is: No, after 10 years your $10,000 will lose value because of inflation. The solution is to invest it in stocks or bonds. Those will “earn” money on your savings and especially with stocks those will generally keep up with inflation.

A lot of my girlfriends are doing Botox now. Should I invest in Allergan?

— Anita from Paris, France

You must run around with a young-looking group of women, but maybe you can’t always read their facial expressions. This is an approach that Peter Lynch (one of the most successful investors of all time) talks about in his book One Up on Wall Street, namely invest in companies who make products that you like in your everyday life.

Allergan is a great company whose stock has been on fire lately. In the past year it’s up over 80%. That begs the question: Did you miss out on the upside with this company. As always, my answer is who knows? Like I told Doug regarding Cracker Barrel, you never know with individual stocks.

That said, great companies are those that make great products that people like. You’re experience tells you that Botox is a great product that people really like. So it makes a lot of sense that you’d invest in the company. It’s a bummer you didn’t do this a year or two ago, but isn’t that always the way?

What do you think about the financial advice from Cosmo to put aside 10-15% of all my income? Or making notes of all my expenses?

— Elizabeth from Houston, TX

Those seem to be really good starts to investing. As I mentioned in this post, the first step in investing is saving money. 10-15% is a great start depending on your age.

Also, tracking your expenses is another great step when you want to get your financial house in order. There’s a common saying in business that goes: “if you don’t track it, it doesn’t change.” When people first start tracking their expenses, I think it’s a real eye-opener when they see where their money is going (“I am seriously spending $180 per month at Starbucks?”). Once you see where your money is going you can start to decide if those expenses are worth it or not.

As I first step, I would suggest a website like www.mint.com. It’s a free website that tracks your credit card spending and then put some decent reports together so you can start to look at your trends. Plus, it’s free!!! Maybe you set up your accounts on Mint and then spend normal for three months. After that, take a look at what you’ve been doing and decide if you should make changes.

All that said, congratulations for taking the first step.