“He saw the horrors and screamed, and that scream was heard for miles”

The world has been battered by a spate of deplorable militant Islamic attacks—17 French killed in the Charlie Hebdo attacks, over 2000 recently killed by Boko Haram in Nigeria plus nearly 300 girls kidnapped and still at large, ISIS beheading and even burning alive hostages, and the Danish attacks just this weekend. It’s beyond tragic, and it’s enough to make some doubt the future of humanity. Translated to investments, events like these increase the VIX, commonly called the “fear index” in investing parlance. As I write this, in no way do I want to diminish or trivialize the horror of these events. What has happened to the victims of these barbarians sickens me, and my heart truly aches for them and their families.

Yet, how should we think of these events in the context of investors? The answer is “not much.” History, both ancient and sadly recent, is littered with these types of tragedies and other events that violently shook the faith of investors. Yet, in each case, while the short-term may have been rocky, investors who stuck it out over the long term were rewarded by attractive returns.

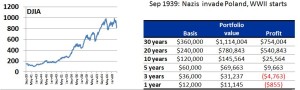

I picked a few significant events, and looked at how an investor would have fared had he invested $1000 per month in the Dow Jones Industrial Average starting in the month of the event and every month thereafter for 1-year, 3-year, 5-year, 10-year, 20-year, and 30-year periods.

Nazis start WWII: In September 1939 Hitler and the Nazis invaded Poland and started World War II. Had someone started investing $1000 that month he would have a loss of $855 after one year and $4763 after three years which is understandable because the world was overtaken by war. But after five years there would be a profit of $9663, a profit of $25,564 after 10 years, a profit of $540,843 after 20 years, and a profit of $754,004 after 30 years. Entering the darkest period of the 20th century, when more soldiers were fighting than ever before, when more people were killed than ever before, when the holocaust was perpetrated and atomic bombs dropped—despite all those tragedies, it was a good time to invest.

Entering nuclear age: In August 1945 Americans dropped two atomic bombs on Hiroshima and Nagasaki, killing 200,000 Japanese civilians. After the Soviet Union developed its own nuclear capabilities in 1949, the threat of nuclear apocalypse and human extinction became a very real possibilities. However, the following years were good years to be an investor; steady investing led to profits for the 5-year, 10-year, 20-year, and 30-year periods.

Assassination of Martin Luther King, Jr: In April 1968 a racist assassin struck down the civil rights leader, plunging the nation into deadly race riots. Race relations precipitously deteriorated, and many could argue remain tragically strained. While investments would have shown a loss after 10 years, they showed a profit after 20 years and an astounding $2+ million profit after 30 years.

Interest rates peak: In January 1982 the US was in its worst economic situation since the Great Depression. Inflation was 12% and interest rates were at 20%, both near the highest levels in the nation’s history; to put those in perspective, today both inflation and interest rates are less than 2%. Back then the economy had never looked so bad, the stock market had been flat for nearly 20 years, and people were openly questioning whether capitalism was a viable economic system. For those brave souls who were buying stocks (and probably chased stock purchases with a swig of Pepto), it turned out to be a great time to be an investor. Every time period—1-year, 3-year, 5-year, 10-year, 20-year, and 30-year—were profitable.

The common theme is obvious: in all of those eras, investors who continued to buy stocks, no matter how scary the world looked at the moment, profited in the long run (of course past stock performance has no bearing on the future). Putting the recent Islamic terrorist events in context with some of the events we just looked at (and again, in no way trivializing or diminishing the horror of these recent attacks), it seems reasonable to assume that as investors there isn’t a lot to fear.

While the recent attacks are atrocious, they seem quite small when compared to WWII, both in terms of human costs and overall destruction. ISIS and Boko Haram have embraced barbaric practices, yet those have a destructive scope orders of magnitude smaller than the horrors of nuclear war. Sadly for citizens in Nigeria, Syria, and Iraq, the threat of these extremists is palpable, yet those countries have tiny GDPs (about 1% of the world’s GDP for those three countries combined) and proportionally small investing relevance; it just doesn’t hit close to home in the big-GDP countries the way the US riots and racial discord did in the 1960s and do today.

As a human, those attacks are deplorable and I want civilized society to do everything in its power to end them and bring the perpetrators to justice. As an investor, they are minimally important to the point of irrelevance.

#bringbackourgirls

2 thoughts to “Impact on investments of terrorist tragedies”