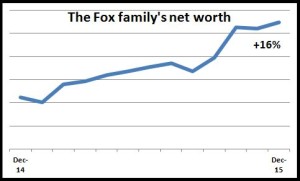

After the last blog on our investment performance in 2015, I got the following email from Scott, a loyal reader from California who I went to grad school with:

What’s amazing is you were able to increase your beginning-of-year net worth by about 25% this year, and that you did this mostly through savings! With that ability to save you almost don’t need returns on your investment portfolio. Do you have any tips on how you did this, especially in a year when you weren’t working? Does the lower cost of living in the mid-Atlantic deserve much of the credit? Was there a nice upward move in your home value?

Scott, California

So I figured I’d do a bit of a deeper dive to give you some more detail about how things worked out for us. Who knows, maybe you were wondering the same things that Scott was.

Crazy cash flows

As I have mentioned, 2015 was a crazy year because of me quitting my job and Foxy Lady getting a new job in North Carolina, leading us to move across country. Those two events were the driving forces behind our fairly crazy finances this year.

When I quit my job we got a cash bolus from Medtronic. I was able to cash out all my vacation, plus I got a severance. So even though I officially separated in August, I got paid a lump sum that would be equivalent to me being paid probably through October or November. That was definitely nice, but money evaporated pretty quickly due to a few things:

- Our dog had a pretty major surgery that set us back about $5000.

- We had to get an apartment to live in in Greensboro while we looked for a house. There were deposits and stuff like that which came to a few thousand.

- All the while, our house in LA didn’t sell so we were still paying a mortgage, utilities, lawn and pool guy, property taxes, and other expenses; all that probably ran to about $5000 per month!!!

- Also, to get the house in LA ready to sell we had to do a little bit of work. Unfortunately that “little bit” actually became fairly big and probably cost of about $15,000 or so.

I didn’t track the numbers 100%, probably because if would have depressed me, but I figure that all the extra money that came as I left Medtronic was more, but not nearly as much more as I would have hoped, than the amount we had to spend on those “moving expenses”. Let’s say we came out to the good $20,000 on this.

Once we got to North Carolina, the cost of living is definitely much lower, especially with things like housing. But because the house in LA didn’t sell, we weren’t really able to take advantage of those lower costs in 2015 because we were paying the double mortgage and all those other costs associated with the LA house. As it turned out we did sell the LA house in the last days of 2015, so we started 2016 with a clean slate. Now, we definitely feel the lower cost of living, but that will all be reflected in 2016.

Also, to Scott’s question, we did make a fair amount on our house, but since we didn’t get that money until 2016, it wasn’t reflected in the 2015 numbers.

Saving in boring ways

So to Scott’s main question, how did we save enough money to account for that increase in our net worth? Because of all the cash flow stuff I mentioned about, we really didn’t have extra money at the end of the month to give to Vanguard to invest. Really our savings came in two main ways: our 401k accounts and our mortgage.

As I mentioned in the last blog, knowing that I was going to quit my job I really tightened the belt and maxed out my 401k in the first half of the year. That was $18,000 which is the IRS max, plus probably about $8000 of matching funds from Medtronic. So that’s about $26,000.

Similarly, Foxy Lady maxed out her 401k, so that was $18,000 plus probably $6000 in matching funds from her two employers over the course of the year. So that was about $24,000.

Our LA mortgage was about $2300 each month, of which about $1300 was interest. So that meant that each month $1000 was going to equity. Over the course of a year, that adds up to $12,000. In September we bought our North Carolina house. Our NC mortgage is such that each month we put about $800 towards equity, so that came to about $3000.

Finally, there were those consulting opportunities that fell into our lap a little bit. This was really found money that we weren’t expecting at all. Since we made these major life decisions, me quitting my job and then moving to NC for Foxy Lady’s job, with the plan that we’d live off of Foxy Lady’s income we were able to take my consulting income and just bank it. Net-net, this came to probably about $30,000.

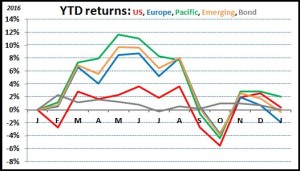

If you add all that up—the money from leaving Medtronic, the 401k stuff, the mortgages, and the consulting, you get about $115,000 which we were able to save. So that’s how we were able to move the needle forward, despite a down market.

Of course, this was a bit of a boon of a year. In 2016 we definitely won’t have any windfalls from leaving Medtronic, nor will we have me saving in my 401k, and who knows what will happen with my consulting. On the other hand, in 2016 we’ll be free from our LA mortgage so we’ll be able to take full advantage of the lower cost of living that NC provides. There’s absolutely no way we’ll save as much in 2016 as we did in 2015, but that’s okay because we planned for this.

I hope this post scratched your voyeuristic itch a little bit. That’s how the Fox family was able to keep moving forward despite a slightly down year.