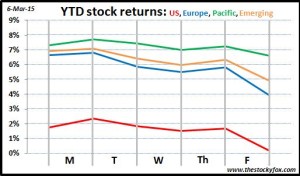

The week was dominated by moves (or anticipated moves) by central banks. We had a pretty flat week until the bottom fell out for everyone. Pacific stocks did the best (Thank you China) being down only 0.7% while the US and Emerging stocks were down about 2%. That leaves the European stocks which really got hit hard, down almost 3%. Wow!!! So what caused it all?

NASDAQ hits 5000 for first time since 2000:

On Monday Wall Street celebrated a bit of a milestone when the NASDAQ returned to above 5000 for the first time since the internet bubble popped 15 years ago. It wasn’t a story to drive the market, as much as it was a story about how the market has been driven by amazing companies like Apple, Whole Foods, Amazon, eBay, Amgen, Cisco, and others. Of course that didn’t stop all the news outlets from devoting considerable time to remembering 15 years ago. My favorite part was looking at the CNBC footage from then and the hairstyles in vogue at the time. You never realize how much those things change, even in a few years, but man do they ever.

Interestingly, the milestone did prompt a lot of soul-searching as to whether or not we were in a bubble now, the way we were back then. 15 years ago, a lot of people got taken up in the euphoria of the skyrocketing stock market, only to get crushed when the party ended. It’s natural to want to look at that now to avoid those painful experiences, but as we learned in A Random Walk Down Wall Street, crashes are really hard to predict. Overall, this was a nice trip down memory lane, but nothing that really had meaningful implications for the markets.

Both China (Monday) and Europe (Thursday) ease monetary policy:

Janet Yellen isn’t the only central banker that can monkey with interest rates to drive markets. The week started on Monday with China lowering its key interest rate. As you would expect, this had a very positive effect on Pacific and Emerging markets. However, this is always a bittersweet move, and one that may have some major implications in the future. China is lowering its interest rate to spur economic activity because it thinks its economy is slowing. In the past several years, China has been a manufacturing juggernaut, so to think that the second biggest economy in the world may be slowing down is not a positive for stock markets.

In a similar story in a different part of the world, the European Central Bank announced that it would mimic the US’s quantitative easing program by buying over €1 trillion (trillion with a “t”) in bonds. Broadly speaking, the European economy is a mess right now. At best you have the stronger economies experiencing slower growth, and at worst you have Greece in shambles and other countries like Italy and Spain thinking about following Greece’s “budgets be damned” path. Certainly quantitative easing seems to have worked for the US (but the jury is still out as to its long-term effects), but Europe is in a very different place economically and politically compared to the US. You kinda get the sense that the ECB is just throwing a bunch of “stuff” against the wall and see what sticks. Not surprisingly European markets were down more than anywhere else, although they had a slight recovery on Thursday with this news (which was erased and then some on Friday).

There is no doubt that lowering interest rates (what China did) and providing liquidity (what Europe did) has a positive short-term effect on stocks. But it’s like eating sugar; that gives you a short burst of energy, but it’s not sustainable in the longer term. Continuing that analogy, a healthy body needs real food instead of sugar, just like a healthy economy needs earnings growth instead of government stimulus. That’s why the markets were up on the day the stimuli were announced but have since fallen lower as people realize the state of the economy as the reason “why” the stimulus was needed.

Benjamin Netanyahu speaks to the US Congress:

When the Israeli prime minister spoke to Congress (without President Obama’s blessings) on Tuesday he took the gloves off and started blasting the Obama administration’s proposed treaty with Iran over its nuclear program. As the speech went on and became increasingly belligerent, stocks softened moderately, but oil started to increase.

The fear of course is that Netanyahu’s speech portended armed conflict in the volatile Middle East. A regional conflict wouldn’t be that big of a deal since the Middle East only represents about 3-4% of the world economy; that’s a significant amount but not a lot. The initial concern is oil and the disproportionate amount that is produced there, and you saw how the threat of war impacted oil prices for a day (of course, the enormous glut in world oil reversed those gains quickly).

The bigger concern is that region has a tendency to draw other countries into its conflicts, especially the US. As we know, wars are expensive and tend to be bad for the stock market as a whole (although good for particular industries like defense). While the odds of that are pretty slim in my opinion that there is another Middle East war in the US’s future, Netanyahu’s speech showed the chances are rising, and the stock market acted accordingly.

Supreme Court hears arguments against Obamacare:

This is actually a big deal. Healthcare has been one of the huge drivers of the US economy (and the world economy) during the past several years. The Affordable Care Act really reshaped the landscape of the industry, and was largely seen as a boon to healthcare companies who started receiving more customers because of the insurance mandate. Additionally, the government’s subsidies of insurance for lower-income people acts as a huge financial injection from the Treasury to the pockets of the health care industry.

As the Supreme Court reviews a key provision of the law, there’s the potential that all of Obamacare could unravel (certainly something the Republicans want). That would be bad for the health care companies for sure. When news came out that Justice Kennedy made some comments that seemed skeptical of the challenger’s case, hospital stocks rose sharply. But even the uncertainty surrounding all this is bad, making it really hard for these companies to plan very far into the future, and I think that’s another reason that generally you saw stocks soften this week.

Friday’s news was dominated by the jobs report. The good news was that employment was up, with the jobless rate being at its lowest level in about seven years, so that definitely seems to be a good thing (although the calculation is kinda weird because it doesn’t include people who have stopped looking for jobs). However, the types of jobs are not high-paying jobs as reflected by the fact that wages were flat. This means that more people are working, but they are tending to be lower paying jobs which is definitely a sign of underemployment.

Overall this has to be net good news, but of course it would be better if both employment and wages were rising for the economy. Interestingly markets were down sharply on this news, which is counterintuitive; I think it’s probably because this good news makes it more likely the Federal Reserve will raise interest rates sooner. But of course, that would change a million more times in the next few weeks.

So there you have it. A bit of a bummer of a week for the markets considering we were on a pretty sweet winning streak. Unfortunately, except for the NASDAQ 5000 celebration (ironically, the NASDAQ promptly fell to 4980 after it hit its mark) there seems to be some developments that are genuinely concerning. I hope you have a great weekend and I’ll see you tomorrow with my review of The Millionaire Next Door.

Your updates for the week are right on, great summaries. I just heard that with the NASDAQ finally over 5000, it has to get to 6900 just to break even with inflation over the past 15 years. One of the worst investments of the last decade.

Paul–Thanks for the comment. It’s crazy that the tech bubble was 15 years ago (that makes me feel old). Technology investing has certainly been a wild ride (and continues to be). Fortunately, even though valuations are high right now (https://thestockyfox.com/2015/03/my-optimism-overfloweth/) there no where near the nose-bleed levels of 2000.