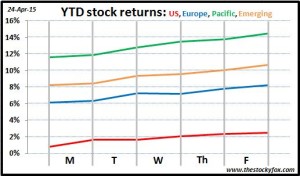

Remember last week? Everything was going great until Friday hit, and the bottom fell out of the market. Well, this week was looking just like last week—through Thursday we had a steady upward trend going and everything was great. Then Friday happened, and this week, instead of dropping like a stone, the markets kept trudging upward. Yeah!!!! We like weeks like this.

This seems like a “no-news-is-good-news week.” We didn’t have a single day where markets were up over 1%. Yet, just a steady upward march had markets in the black across the board—from 1.7% for US markets to 2.9% for Pacific markets and Europe and Emerging markets in between. That’s an amazing week by anyone’s standards, yet in kind of seems like it flew under the radar screen.

It’s still about earnings:

As has been the case for the past couple weeks, we had a lot of companies announcing their earnings, and it all seems to be generally positive. Microsoft beat their earnings target on the strength of its hardware sales and cloud computing. Amazon similarly beat expectations with strength across all its business. Keeping up with its Seattle big brother, Starbucks had a strong quarter thanks to 18% revenue growth.

Of course, there were some companies that didn’t do nearly as well, but there seemed to be a silver lining even in those cases. General Motors showed powerful revenue growth (up 400% from last year); GM did miss its earnings estimate, but even there they are showing they’re going in the right direction. Google grew revenue about 15% which fell short of expectations (are you kidding me? 15% seems like a lot of growth to me, especially for a very large company).

So there was good news and bad news. But the bad news didn’t really seem all that terrible. Companies were growing revenue a lot, just not as fast as Wall Street would have liked. That seems like a pretty good problem to have. I look at this week’s earnings, and really earnings for the whole season, as a feel-good story. Revenue is growing, innovation is happening, the US is going strong and Europe finally seems to be getting its house in order. Those are all positives for the market, and investors were rewarded with an amazing week.

The merger that never was:

On Friday the big financial news was that Comcast called off its acquisition of Time Warner Cable. This was a gigantic move, valued at about $45 billion. Ultimately, regulators killed the deal over a variety of issues, mostly of the anti-trust variety. It seems Comcast finally threw in the towel and moved on.

Interestingly, Time Warner Cable’s stock was up about 5% today on the news. This may seem counter-intuitive since target stocks tend to go up when they’re being bought, not when the deal is scuttled. So what gives? I think over the past several weeks and months, as it became apparent there was a lot of resistance to the merger, both companies stocks took hits. Once the parties finally agreed to go their separate ways, that allowed both companies to focus on the future without dragging around this merger anchor.

In past posts, I’ve been a true believer that mergers are a sign of good news for markets. I still believe that, but I think this one just wasn’t destined to happen. I am sure there were amazing synergies that they could have brought to consumers, but anti-trust concerns (which are very valid, and I’m glad the government tries to preserve competition) were just too big a hurdle. Oh well. Dust yourself off and move on.

I hope you all have a great weekend. On Monday I am going to try to answer the question: “Should you use an investment adviser?”