“You can’t hit what you can’t see” –Walter Johnson, major league pitcher from 1910s

As you take more control of your personal finances, there will come a time when you need to start tracking it somehow. Maybe you’ll be hyper-obsessive like I am and look at it multiple times a day (which objectively is stupid since the numbers don’t change that fast, but I do it anyway). Or maybe you’ll want to see what things look like every week or every month to make sure you are on track. Either way, you’ll need some way to track your finances.

There are two major options: a program you purchase and install on your computer like Quicken, or an internet website that consolidates your online accounts like Mint. For the longest time I was a Quicken devotee (and before that I used Microsoft Money), and then I recently switched to Mint. This post is going to be looking at the pros and cons of each, Dr Jack-style, to help you pick the one that will work best for you.

TRACKING SPENDING: Both do this fairly well. You can download your bank and credit card activity, and both do a somewhat decent job classifying the expenses into the different categories. I think this is a bit of “the price of admission” that you should absolutely expect.

There is one feature that I really liked about Quicken that I don’t get with Mint—the ability to split expenses. When I go to Costco and spend $300, I can only use a single category in Mint, so I use “groceries”. However, in real life, that $300 was split into $150 for groceries, $30 for pet food, $70 for Foxy Lady’s contacts, and $50 for some pool toys for Lil’ and Mini. In Quicken I can split that $300 expense into those different categories which is really nice when you want to compare your spending to your budget.

[EDITOR’S NOTE: After posting this, a reader named Ashleigh mentioned that you could indeed split transactions in Mint. It took some tinkering around but I figured out how to do it. She was indeed correct. That said, I must say that it’s not the most user-friendly or intuitive process. But hey, it’s free so I can’t complain, even though I just did.]

Advantage: Slight edge to Quicken

PROJECTING FUTURE SPENDING: This is a really nice feature in Quicken that you don’t have in Mint. When you look at the cash flow of your checking account, it’s nice to look into the future to make sure that your balance doesn’t fall below a certain level. So you might get a paycheck or two, but then you’ll have your mortgage, a credit card payment, and a couple bills, all of which are hitting on different dates. That’s a lot of moving parts.

If you’re like me and you try to keep your checking account’s balance fairly low, freeing up the extra money to invest where you can get a higher return, then you need to be a little more precise. This is probably the single biggest feature that I miss by switching from Quicken to Mint.

Advantage: Quicken

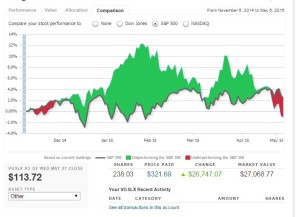

ACCURACY: With Mint the website downloads your transactions and then does its thing. Most of the time this works well but sometimes it doesn’t work and the results look goofy. Look at the picture from Mint for one of my investments. Notice how it thinks that I invested $321.69 and that has increased $26,747. While I would like to think that I am that brilliant of an investor, I can assure you I’m not. For some reason the download had a bug in it. With Quicken, you can actually go into the file and manually change things to take care of stuff like that.

Advantage: Quicken

NON-BANK STUFF: A lot of people have financial “stuff” going on that isn’t with your bank or brokerage account. Sometimes it might be off-the-book loans like maybe your parents helped with the down payment on your house. With us, I have stock options that aren’t in an account compatible with Mint, so I don’t have visibility to them. With Mint, if you can’t download them they don’t exist. Obviously that creates a bit of a problem if you want to take these into account.

With Quicken if you have stuff like that you can manually create accounts and transactions. It’s not ideal and certainly not as easy as downloading them, but sometimes something is better than nothing.

Advantage: Quicken

ANALYSIS: Quicken has a lot more robust offering of analyses that you can use, including a host of reports that you can customize to show whatever you want. I used these to track how my spending was doing to my budget as well as a report that showed how my investments were doing. Mint has some useful reports, but it isn’t anything near as robust as what Quicken has.

However, Quicken does have a bit of overkill. There are all kinds of reports that it offered that I didn’t use, or even worse used and thought gave bad advice. Quicken had a retirement projection tool that I played around with. It said that at 65 I would have something like $5 million, but that I would run out of money by 90. Ludicrous. I didn’t use that tool after that.

Advantage: Quicken

CONNECTIVITY: This is one of the areas where Mint really shines. Its whole platform is based on smooth, seamless connectivity with all your accounts. Everything is designed to make this easy—from initially linking your accounts to Mint, to updating them. I love Mama and Papa Lynx (my in-laws) to death, but sometimes they aren’t the most technologically savvy. They got everything up and running in Mint without any problems, so you know it’s pretty user-friendly.

This is the main reason that I don’t use Quicken anymore. I kept having problems where my accounts wouldn’t update. Sometimes it was my accounts would change (like when my Vanguard account got large enough to go to their Admiral shares), other times it would be a cookie or some other technical thing on my browser that I don’t really understand. No matter, it would be a royal pain in the butt. I’d have one of three options, none of which were good: I could spend time with their technical support, I could manually enter the transactions, or I could just not update (what I ended up doing). We live in a technical age, so to have this not work really well is a problem.

Advantage: Big advantage to Mint

TECHNICAL SUPPORT: As you would expect with a free site on the internet, Mint doesn’t offer you a lot of help if things go wrong or you screw something up. If you click on the “get help” link it sends you to a page that recommends you try to find the answer to your problem in their community. So basically you’re hoping that you can find someone who had the same problem you did and wrote about it. That’s kind of an “f-you”, isn’t it? I’ve struggled a couple times and found my answers by googling for it, and it worked but it took a bit of effort.

Quicken on the other hand has a bonafide help center. You can chat with a real person who will try to help you. This is what I used when I had connectivity issues. By and large, they’re pretty good and can solve most problems with a minimum of hassle (although it’s probably a minimum 30-minute time commitment). Maybe I’m stuck in the past, but I do like it when I can talk (either over the phone or via chat) to a live person.

Advantage: Quicken

INTEGRATION TO OTHER PRODUCTS: Quicken allows you to upload your files to programs like Turbo Tax and also to spreadsheets if you really want to do some hardcore analysis. But this is another feature that I think sounds really great, but when you really think about it, it might not be all that valuable.

Take the tax thing for instance. I supposed you could download all your stock sales from Quicken into your tax program to calculate your capital gains, but who really does that? Doesn’t everyone just take the form that Vanguard or Fidelity or whoever sends you and plug all those numbers into your taxes? In all the years I used Quicken I never once used these features.

Advantage: Irrelevant edge to Quicken

COST: Mint is free, and that is awfully hard to beat. Quicken on the other will set you back between $50 and $100. Plus Quicken uses planned obsolescence where their product stops working after a while (it stops connecting to the internet to update your accounts), so you have to buy a new version every couple years. Certainly a few hundred dollars over a decade isn’t going to change the world, but I’d rather have it in my pocket than in Intuit’s.

Advantage: Big advantage to Mint

So there you have it. Looking at it, Quicken has more advantages than Mint, and that makes sense. Quicken is a better, more powerful product, no question. However, Mint has probably the two biggest advantages—its connectivity and it’s free.

I appreciate that I am a power user when it comes to these things, and even I find a lot of Quickens extra features overkill, and I just don’t end up using them. That makes me give the verdict that Mint is probably the better choice for most of you out there. But don’t shed a tear for Quicken and their parent company, Intuit. It turns out that Intuit owns Mint as well. So there’s a lesson in cannibalization.

What is your opinion on Mint or Quicken or any other system you use to track your finances?