“Time heals all wounds”

Over the last two blogs we started to answer the central question of personal finance—when can I retire. This complex question really breaks down to two elements: How much will you need?, and How much will you have? This blog ties them together with the time element of WHEN. When will what you have be enough for what you need? This blog will tie those two pieces together and we can figure out When Skinny Fox can retire.

“X” marks the spot

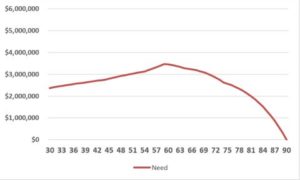

You can imagine drawing a graph looking at how much you’ll need in retirement based on how many years you plan on being retired. At the extreme, if you planned on working until the day you died, you would be in retirement for 0 years, so you would need to save $0 for your retirement. You’ll need more for a 10-year retirement than a five-year retirement, and so on. Hopefully that is fairly intuitive.

The assumptions we made for spending in retirement would make the following table (just to make things easy, let’s assume we’ll live to 90 years old):

| Age |

Nestegg size needed—in today’s dollars |

| 90 |

$0 (remember, we die at 90) |

| 89 |

$43,000 |

| 85 |

$205,000 |

| 80 |

$383,000 |

| 70 |

$731,000 |

| 60 |

$1,122,000 |

| 50 |

$1,309,000 |

| 40 |

$1,556,000 |

That graph would look something like this:

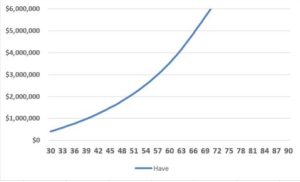

Also, in the last post we drew a graph that showed how much we would have saved at different ages. It looked something like this:

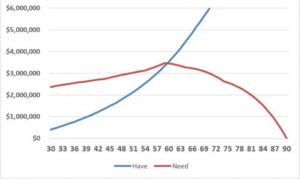

If you ever took an economics class you know that the answer to pretty much any question is “where the lines intersect.” If you put those graphs together, where they crossed is where you would have saved enough money (blue line) to be able to afford your spending in retirement (red line). In this case, the answer is $3.5 million (future dollars).

If you look at Skinny Fox’s age, she’ll have saved that much money when she’s 60. Also, at age 60 is when she’ll need $3.5 million to see her through retirement. X marks the spot.

It’s the process, not the answer

There you go. Skinny Fox can retire at 60. We should all retire at 60. Glad we figured all that out. Buuuuuutttttt, wait a second. The whole point of this isn’t to figure out a number, per se. That’s important, but what is much more important, especially as you are planning your financial future, is figuring out how your decisions impact that number.

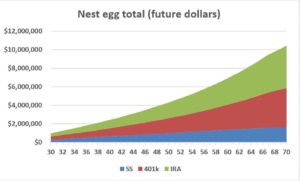

This process we went through is enormously complex with a ton of variables and calculations on a fairly involved spreadsheet . If you’re good with spreadsheets and compound interest, you can figure all this stuff out and understand the impact of your choices. If not, maybe your friendly neighborhood Stocky Fox can help.

To keep things simple let’s look at the two major variables that got us here:

- Spending in retirement: Skinny would spend about $6,500 per month in retirement, and that would naturally go down as she ages.

- Savings while working: Skinny would save 6% of her salary in her 401k, save $5,000 in her IRA, and of course get Social Security.

As is, those two ingredients spit out age 63. It becomes really interesting when you start to change those inputs.

Enjoy life in the now

Maybe Skinny Fox looks at life and thinks that you only live once, so you have to enjoy life in the “now.” You never know what the future holds.

She wants to use her handy dandy spreadsheet to figure out what would happen if she saved less today. The intuitive answer is obviously that saving less today means she’ll need to retire later or she’ll be able to spend less in retirement.

Instead of saving $5,000 in her IRA each year, let’s say she cut that in half and only saved $2,500. She could still retire at 60 but that would mean she could only spend about $5,700 per month in retirement, a decrease of about $800 or 15%. Conversely, she could still spend $6,500 monthly in retirement, but then she would have to push her retirement back to age 62.

We could run a few scenarios and get the following table:

| IRA/extra savings | Retirement spending | Age of retirement |

| $5,000 (base case) |

$6,500 |

60 |

| $2,500 |

$5,700 (spend less) |

60 |

| $2,500 |

$6,500 |

62 (work longer) |

| $0 |

$5,000 |

60 |

| $0 |

$6,500 |

64 (work longer) |

Retire in style

Maybe Skinny takes the opposite approach and wants to work hard now to ensure she can spend to her heart’s desire once she’s retired. We can use a similar approach.

Instead of spending $6,500 per month, she could spend $7,500. That would require her to save an additional $x,xxx per month while she’s working, or it would require her to push her retirement from 63 to xx.

Again, we could run a few scenarios:

| IRA/extra savings |

Retirement spending |

Age of retirement |

| $5,000 (base case) |

$6,500 |

60 |

| $8,200 |

$7,500 |

60 |

| $5,000 |

$7,500 |

62 (work longer) |

| $15,800 |

$10,000 |

60 |

| $5,000 |

$10,000 |

67 (work longer) |

Time is the most valuable thing we have

You’re probably starting to get the point. There are two variables, how much you save and how much you spend. You can move those around however you want. The third variable of age balances everything out.

Interestingly, the age variable seems to be the most powerful. If Skinny wanted to retire five years earlier, at age 55, she would either have to save an extra $4,800 each month or she would need to reduce her spending in retirement by $1,100 each month (that’s about 20% which seems like a big reduction).

Conversely, if Skinny was willing to work an extra five years, retiring at age 65, she could spend $3,300 more each month in retirement or completely skip her IRA.

That seems a bit surprising that over a 40+ year career that just a five year swing (a little over 10% of a working career), one way or the other, has such a big impact. The reason is working an extra year has a triple-effect. It gives your investments an extra year to grow, it gives you an extra year to build your nestegg, and it reduces the time you’ll be retired. Obviously, the opposite is true too if you want to retire at a younger age.

Clearly you can see the tradeoffs Skinny needs to make. Is it work spending more now if that means having to work longer? Or having less to spend in her golden years?

There’s no right or wrong answer, and it’s a deeply personal decision. For the Fox family we made the decision to retire early. This meant spending less in retirement, but when we did our math we found that we could stop working and still maintain a reasonable lifestyle. Sure there are times now when we wish we could spend more, but given the time/spending tradeoff, I think we’re pretty happy with our decision.

How do you feel about the time/spending now/spending later tradeoff?

We’ve covered a lot of ground here. I hope this gives you a sense of “what is reasonable,” both in terms of how much you’ll likely spend in retirement and how much you’ll save. Also, it let’s you get a sense for the tradeoffs you make by spending today and how that impacts tomorrow, and vice versa.

However, I think the biggest epiphany for me at least was how important timing is. Everyone will be able to retire. It’s just a matter of when.