“In this world nothing can be said to be certain, except death and taxes” –Benjamin Franklin

I love this woodcut from the 1600s. I imagine the artist drew it so the skeleton’s hand is asking for the guy’s life, but it kind of looks like he has his hand out asking for money like he’s collecting taxes. Either way, if you’re death or the tax man, you probably aren’t too popular.

Obviously taxes are important when you’re thinking about investments and your retirement. Uncle Sam (for all you foreign readers, what is the name of the personified tax collector in your country?) is definitely going to take his share of your earnings and investments. Given the progressive nature of most countries’ tax codes, as your nest-egg gets larger and larger, they take a bigger percentage, so that raises the stakes.

The government has built the tax code to offer huge tax breaks to people saving for retirement, particularly allowing people to defer taxes from their earning years to their retirement years. That’s really all that accounts like 401k’s and IRAs are doing, taking money you earn when your income is high and allowing you to pay taxes on it when your income is low. It may not seem like a big deal at first but suffice it to say, optimally managing your tax situation can be the difference of hundreds of thousands of dollars. As always, it’s important to remember that I’m not a tax expert; also I’ll be making assumptions on future stock returns which in no way guarantee that is what will actually happen in real life.

Working tax rate versus retirement tax rate

US tax rates go up pretty quickly the more money you make. So when you’re in your prime earning years, that is when your tax rate is going to be the highest. Take my old neighbors Mr and Mrs Grizzly as an example. They both work and have a combined income of $150,000. Throw in a couple assumptions like they have two cubs, a mortgage, and live in the great state of California, and they are paying a total of about $41,000 in taxes, about 27% (there’s a great website that I used for these estimates). Look a little deeper and their marginal tax rate is 43%; that means if they earned one more dollar they would pay $0.43 in taxes, and conversely if they lowered their income by one dollar they would save $0.43 in taxes. Wow!!! That’s a lot in taxes.

Now let’s fast forward and think of Mr and Mrs Grizzly in retirement. Their house is paid off and they don’t have to save for their cubs’ educations, so what they need to support their retirement lifestyle is $80,000 (believe me, I will have many future posts dedicated to estimating how much someone needs per year in retirement, but for now let’s just take the $80k on faith). Each year they tap into their savings and the $80,000 breaks down into three buckets: $20,000 is interest and dividends; $30,000 is long-term capital gains on the profits from their investments over the years; and $30,000 is the basis, the original money they invested which doesn’t get taxed. Run your tax calculator again and they’re paying a measly $1,200 in taxes!!! Read that again; it’s not a misprint. That’s only 2% compared to the 27% they were paying while they were working. And their marginal tax rate is 4% in retirement instead of 43% while they were working.

That, my friends, is some powerful stuff!!! Now, how do Mr and Mrs Grizzly translate that into cash money?

The value of deferring taxes

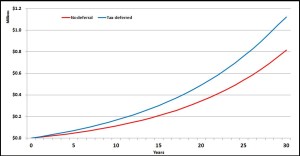

During their working years, Mr and Mrs Grizzly set up their budget to save $1000 per month. Because they are avid readers of the Stocky Fox, they know they should save that through their 401k’s (in this unfortunate example, let’s assume their cheapskate company doesn’t offer any matching). In a year they will have saved $12,000 but since 401k’s are tax deferred they don’t pay taxes on that money, saving themselves $5160 in taxes (remember, their marginal tax rate is 43%). Nearly $5200!!! That’s some serious honey comb. They do that each year and after 30 years (let’s assume a 2% dividend and a 5% stock increase), and they have a nice little honey pot of $1.12 million for retirement. They’ll withdraw their $80,000 per year and pay the lower tax rate on it, and life is good.

The Grizzleys are sitting pretty, but what would happen if didn’t use their 401k to defer taxes and instead invested their money in a normal brokerage account? Each year, they’d pay the $5200 in taxes but then they would also have to pay taxes on the dividends. If you assume the same investments as we did above, 2% dividends and 5% stock increase, after 30 years they would have $815k. That’s nothing to sneeze at, but that’s about $300k less than what they had with their 401k. Those numbers seem crazy, but that’s the power of tax deferral.

So the lesson is that using tax deferred accounts offers a really powerful way to accelerate the growth of your nest-egg by cutting out the tax man (in a totally legal way, of course).