For those of you who have been following the Summerfield Open, you know that those tests for 4th and 5th graders had a major focus on applying mathematical principals to personal finance. Many of the kids got interested in investing because of those questions which led parents to ask me how their kids can start investing in stocks. Here is how I would approach it.

Of course, remember this is just friendly advice. I am not an expert and you should call the broker (I suggest Vanguard) or work with a paid advisor. With that out of the way, here’s what you can do:

Fun or boring

We’ve talked ad nauseum on this blog about the best investing strategy being buy and hold index mutual funds. This is a tried and true approach, but it’s boring. When you’re thinking about how to get kids excited about and engaged in investing, that’s a conundrum.

You want investing to be exciting for the ankle-biters to hold their attention. If you’re an ankle-biter who is looking to start investing, the point may be less to make a lot of money. Rather, it might be to gain experience investing. Yet, you want them to develop good investing habits that will pay dividends (haha, do you see what I just did?) for the rest of their lives.

With all that, I think you want to have a foundation of correct investing principals (boring), and then try to mix in some fun into that. Let’s look at those investing principles and see which should apply to the padawans:

- Diversification—This is a critical concept that you want to have early on. Investing in individual stocks might make it a bit more tangible for the munchkin (you’re investing in Apple which is the type of phone mom has), but I think you can do something similar with a mutual fund or more likely ETF (more on that in a minute). Individual stocks will be more volatile which will translate to more exciting for a munchkin, but ETFs will definitely have plenty of action.

- More diversification—As you look to diversify an important concept is “total coverage”. You want to have investments everywhere. That might be a bit harder for individual stocks because it’s not always easy to know the exposure that a company has geographically (you’re investing in Ford because that’s the car dad drives, but how much of their business is in the Middle East?). With ETFs you can overtly pick US funds or European funds or Pacific, etc. That gives a bit of a built in geography lesson too, so there you go.

- Minimize costs—We’ll have a whole section on this, but costs are especially important for the half-fries. They probably don’t have a lot of money to invest (remember, investing is probably more for the experience than the wealth creation). With a smaller portfolio a $5 or god-forbid $15 transaction fee to buy some shares of stock would have an outsized negative effect on a $100 portfolio compared to a $100,000 “adult-sized” one (but even adults shouldn’t pay transaction fees).

- Hold investments for long term—This is critical for wealth creation, but I think we sacrifice that for the tadpoles. Trading is “exciting” and keeps them engaged. Fortunately, because of the Random Walk there’s no reason to believe that more active trading will negatively impact the portfolio beyond the transaction costs (mentioned above, and again below). So here I say have a lot of fun and dip your toe in and out of the different investments somewhat frequently to keep it exciting.

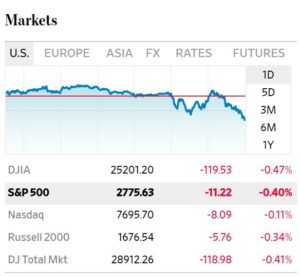

- Track your investments—This is probably even more important for the spuds. As an adult it’s actually a bad thing to be looking at your portfolio all the time. However, here I think it’s good. Everyday something will happen with the investments—it’ll go up a lot or down some or something. There are amazingly great math lesson here—calculating returns, making graphs of what’s going on. If you want, as a parent you could really dig in and make this a huge adjunct math course.

Setting things up

Fair warning, the advice I am giving here might be illegal. I strongly recommend you talk to an investment professional as you do this.

Unfortunately, to set up a brokerage account that allows you to trade in stocks or ETFs or what ever, you need to be 18. So that’s a problem for the half-pints. As a parent you would need to take said half-pint’s money and invest it in your (adult’s) account. Technically, the money will belong to the adult, but perhaps you can make a deal with your half-pint to “promise” it will go back to them. Seriously, the IRS does allow gifts between people (I think the limit is $10,000 per year), so I don’t think it should be too big a deal, but do understand the technicalities.

All our investments are at Vanguard, and that is where I would go. You can go to www.vanguard.com, select “Open an account”, say you’ll fund it with a check, and then pick a “general savings account”.

There will be a lot of questions that you’ll need to fill out and then with things like your social security number, a username and password, and other stuff. Get all that done, and then you can call them up and ask for deposit slips so you can send them a check to fund your account.

Minimize costs

Once everything is set up and the money is in your account, you will get to the fun part which is picking your investments. Here I would suggest ETFs, which basically act like stocks—you buy them in whole shares and they trade throughout the day—but they are really like a mutual fund in that they invest in hundreds of companies.

This is where Vanguard really shines. You can open your account for no minimum and then invest as little as one share (each share is typically between $50 and $150). If you invest in a Vanguard ETF (they have a ton of high quality ones—here) they don’t charge any transaction fee. So you can trade and out of them as much as you want. Obviously, you don’t want to be silly, but that works well for juniors who want to experience the trades.

If you want to invest in individual stocks or non-Vanguard mutual funds there is a fee (I think $7 per trade), but I don’t really think there’s any reason to do that.

There are ETFs for everything. For a little dude, I would suggest equities, and here are a few that you might consider:

- VTI—all US companies

- VB—small US companies

- VT—all companies in the world

- VXUS—all international companies

- VDE—energy companies (industry specific)

- VHT—healthcare companies (industry specific)

As you know, I have a huge passion for investing and helping kids. If you’re doing this and need some help navigating things, please let me know.