“If you have to ask how much it costs, you can’t afford it.”—JP Morgan

Imagine that you’re going to buy something that costs over $1000, maybe a flat-screen TV or a new set of tires for your car. At some point during your decision-making process would you ask how much what you were getting costs? Of course you would. Unless you’re JP Morgan, a normal person figures out what something costs before he or she buys it.

Yet that is exactly what happens when people invest their money in mutual funds; they have no idea how much they are paying the mutual fund company to invest their money. I guarantee you ask 100 people who have 401k accounts how much they paid in management fees last year, and less than 5 will know, and those 5 would probably just get lucky. Even humble Mr Fox couldn’t tell you how much I pay Vanguard each year in management fees(important statement so I had to revert to third person), and I’m obsessed with this stuff.

And the crazy thing is with investing there are so many unknowns and random events, namely how your investments are going to do in the future, but one of the things we can control, how much we spend on mutual fund management fees, receives so little focus and attention.

Why are management fees swept under the rug?

First, investment companies have every incentive to hide the fact that these even exist. Obviously,if Vanguard or Fidelity or American Funds can convince naïve investors that there’s no charge for investing their money, they’re more likely to do it—that’s economics 101. SEC rules require that funds publish their management fees, yet they tend to be in the smaller print, much less conspicuous than the proclamation that “Our fund has beaten its comparable benchmark 7 of the last 10 years, before fees.”

Second, the amounts tend to seem small. An actively-managed mutual fund with really high fees could be in the 1.5% range while a really large index mutual fund might bottom out at less than 0.1%. That spread of 1.4% from high to low may not seem like a lot on its surface, but that’s a 15x range. Also, due to the magic of compounding, over time, those fees would really add up. That difference in management fees could lead to a 13% difference in a person’s nest egg; that’s the difference between someone with high expenses having $500,000 in their 401k after a 30 year career and $565,000. That’s real money!!!

What are the key determinants in how much a mutual fund charges for fees?

The single biggest factor in how much a mutual fund charges in management fees is whether it is a passively managed index fund or an actively managed fund. Index mutual funds don’t require much oversight. They find the index they want to mimic, like the S&P 500, then they have a computer program that monitors the fund’s holdings and makes small course-correction trades to ensure that the composition of the fund is as close to the index as possible. You have a couple people make sure the computer doesn’t go crazy and you’re set. There are still costs like accounting,marketing, keeping the website up, sending out account statements, etc., but it’s a pretty lean operation.

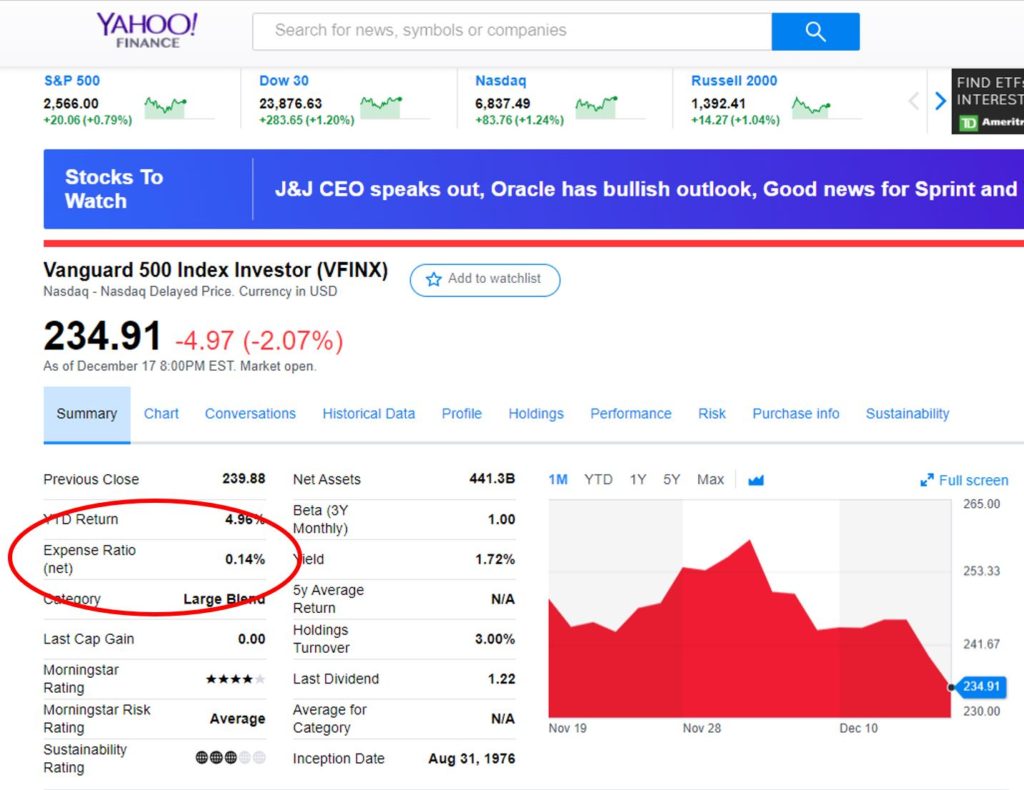

Also, with index mutual funds, in many ways they’re a commodity. Any S&P 500 index fund performs 99.99% identically to any other; that’s the very essence of an index mutual fund. So if there is no difference in the product, then companies must differentiate on cost. Not surprisingly, what is largely considered the best S&P 500 index fund (if you count it in terms of amount invested)is the one with the lowest costs: the Vanguard S&P 500 Index (VFINX).

Now on the complete other end of the expense spectrum you have the exorbitant fees associated with actively-managed mutual funds. There are mutual fund managers who get six-,seven-, and sometimes even eight-figure compensation packages. What justifies such astronomical pay? Just like free-agents in baseball these fund managers who are perceived as the best can go to the highest bidder, becoming celebrities in their own right (see: Lynch, Peter).

Beyond the compensation for the fund managers, these funds have a lot of costs. There are all sorts of industry and trade conferences that fund managers go to. And if you think they fly coach and stay at a Holiday Inn, I have a bridge to sell you. They work in glass palaces in downtown Boston and New York. Let me just say I once went into Fidelity’s headquarters in Boston and to quote a line from one of my favorite investing movies, Barbarians at the Gates, “it makes Buckingham Palace look like a Burger King.” Many offer gourmet lunches to their staffs every day, limos, in-house massage therapists, and the list goes on, but you get the point. And where does all this money come from? It comes from the extra 1.4% difference in management fees between an actively managed fund and an index fund.

Where can you find the information?

This fancy thing called the internet actually makes this pretty easy to look at. Pretty much every finance website (Google,Yahoo!,etc.) lists every mutual fund’s expense ratio. This allows comparison shopping to be really easy. In about 5 minutes you could look up and compare the management fees of any of the mutual funds you are considering.

That’s not to say this is the only factor you should consider when choosing a mutual fund. That’s some deep water which would be a great topic for another post,but it is a really important one. Some would even argue that it is the single most important factor. Sadly it’s one that very, very few people are knowledgeable of. As you look to build your nest egg, it’s something you should absolutely know when you start making your investment decisions.

For our money, the Fox family is a believer in index mutual funds. In fact, 100% of all our money is in index mutual funds, so this is no joke to us. The management fee varies for each fund,management fees for US funds tend to be a little higher than international funds, but the range is about 0.05% to 0.20%, with the average coming in around 0.08%. So we are paying 0.08% of our total nestegg each year in management fees.

That’s what I do, but that doesn’t mean you have to do the same. There are many vocal proponents of actively managed mutual funds (by buddy Mike from Boston). Their points become especially compelling at times like this when the market is going down.

Believe what you will, but if what ever type of mutual fund you invest in you should always know what you are paying. After all, you aren’t JP Morgan. If you are paying a high management fee, just make sure you are getting your money’s worth.

2 thoughts to “Mutual fund management fees: the silent killer”