I’m trying to build my audience, so if you like this post, please share it on social media using the buttons right above.

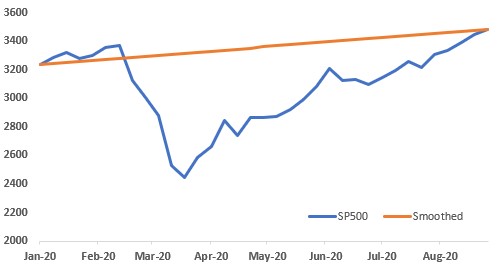

It certainly looks like the stock market has recovered from the Covid pandemic. Sure, some people may say it will crater again in the fall when flu season hits, but I don’t think it will.

The 2020 stock market seems like a movie. Things started off great and then there was a huge disaster. When things looked their bleakest, we saw things turn around, and in the end we had a happy ending where things were even better than before. Star Wars, Harry Potter, Lord of the Rings, and now the 2020 stock market.

Buried in this roller coaster was a tremendous way to make a lot of money in the stock market. I’m not talking about predicting the future where you had the perfect foresight to sell in February and then buy back on March 23 when things bottomed out. That’s impossible.

However, I am talking about a tried and true method of investing that we talk about all the time-dollar cost averaging.

Dollar cost averaging during Corona

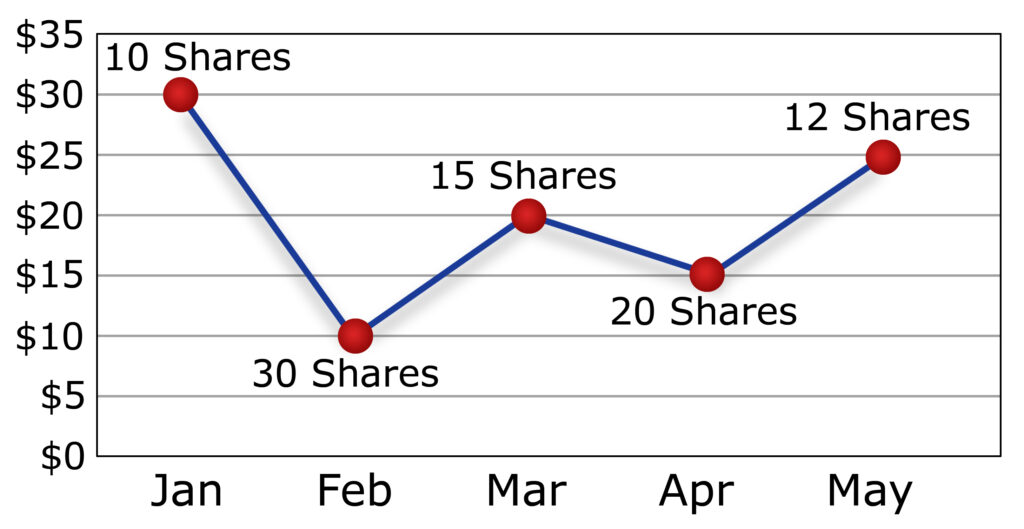

If you need a quick reminder, dollar cost averaging is taking the money you want to put in the market, and investing equal amounts each week or paycheck or whatever.

For example, let’s assume that you invest $1000 per month ($250 per week). If you were able to do that and could keep your discipline, you would have made about $1200. In fact, because of the Corona market crash, you would have made about $900 more than if 2020 had been smooth sailing. Let me explain:

The S&P 500 started the year 2020 at about 3200, and now it’s at about 3500, a bit less than a 10% increase. If we lived in a pretend world where the stock market smoothly and steadily increased from 3200 to 3500 over these past eight months, you would have invested $250 each week and would now have about $9300. That first week you would have gotten so many shares for your $250, and then each subsequent week the stock market would increase, so your overall portfolio would rise in value but the number of additional shares you bought each week would decrease. But hey, you’re up, so that’s good.

However, what really happened, although much crazier and more stressful ended up being better for you at the end of the day. We know that that 2020 stock market wasn’t smooth—it increased early on then had a massive, once in a century crash, after which it had about as steep a V-shaped recovery as we’ve ever seen.

If you were investing that same $250 each week, things would have seemed pretty normal the first two months. However, once March hit the stock market cratered. The value of your investments plummeted which was bad, but the silver lining was that each month you were buying additional stocks at a much lower price. That meant you were getting more shares for each $250 you put into the market.

At the depths of the crisis, if you were able to keep your investing discipline, you were buying stock at about 30% off. Think of it like getting stock from Kolh’s instead of Macy’s; exact same stuff just on sale. Even after the market started its recovery, you were still able to get stocks at cheaper than you would have in that fantasy, smoothed-out scenario.

If you do all the math, it actually adds up to some pretty decent cheddar. Through those eight months, at $250 each week, you would have invested a total of $9,000 (36 weeks). That’s probably not too far off from what you may normally invest in your 401k.

In the smoothed scenario, you would have grown that $9,000 to $9,342, a profit of $342. That seems pretty good given everything we have gone through so far in 2020.

| Real life Corona | Pretend smoothed | |

| Amount invested each week | $250 | $250 |

| Weeks | 36 | 36 |

| Total amount invested | $9000 | $9000 |

| Investment value at end of August | $10,233 | $9,342 |

| Investment gains | $1,233 | $342 |

However, in real-life, thanks to dollar cost averaging, you would have grown your $9,000 to $10,233, a profit of $1,233. Obviously, that’s quite a bit more and it speaks to the power of investing discipline.

When things were their worst, in late March, it was hard, really hard, to keep the faith and continue to put money into the market. However, like every other time in the modern history of the stock market, if you were able to follow Rudyard’s advice and keep your head, things came around.

Obviously there’s a moral to this story which is Investing is a long term game. The Corona stock market came and went over the course of a couple months. Things looked terrible but then they improved. If you can stay disciplined, the stock market will give you its riches.

Encouraging!