In the United States, Social Security is an important part of most peoples’ retirements, actually probably too important in many instances. Social Security is a fairly simple program that was designed to be pretty idiot-proof. You don’t really need to make many decisions for it, which contrasts sharply with all the decisions you need to make on your other investments (like tax strategies, asset allocation, picking investments, etc.).

With Social Security, you just work and the government takes its 12.4% (6.2% from you and 6.2% from your employer) of your compensation. In fact, you don’t really have a choice in the matter and the government does it automatically. Then when you get old, the government gives you a monthly pension. Not real complicated on your end.

However, there is one really important decision you need to make regarding Social Security: when you start taking it. Basically, you have three options: 1) Early retirement-when you turn 62; 2) Regular retirement-when you turn 67 for most of us; 3) Late retirement-when you turn 70. And as you would expect, if you start taking Social Security later, you get a larger monthly check from the government.

This is obviously an important choice to make, and it’s one that gets a lot of press coverage with all sorts of people opining on what to do (I guess with this post, I am adding my opines to those ranks). Generally speaking, the advice slants towards taking it later. Yet, I wonder if that’s really good advice. Using my handy-dandy computer, let’s go to the numbers to see what they tell us.

I checked my Social Security statement and I’ll be able to pick from one of the three choices:

| Age to start taking Social Security | Monthly check |

| Early retirement—age 62 | $1800 |

| Full retirement—age 67 | $2600 |

| Delayed retirement—age 70 | $3200 |

As you would expect, the answer to this riddle is a morbid one. When do you expect to die? The longer you live, the more it makes sense to delay taking Social Security so you can get the bigger check. That’s not a tremendous insight, but when you do the math, you start to see some interesting things going on. I fully appreciate that Social Security is very nuanced and complex, so I am just covering the simple basics here.

In my analysis to be able to compare the different scenarios, I assumed that I saved all the Social Security checks and was able to invest them at 4%, about the historic rate for a bond. If you do that the table above expands to this:

| Age to start taking Social Security | Monthly check | Highest value |

| Early retirement—age 62 | $1800 | Die before age 79 |

| Full retirement—age 67 | $2600 | Die between age 80 and 84 |

| Delayed retirement—age 70 | $3200 | Die after age 85 |

That’s pretty profound actually. The average life expectancy in the United States is 76 for men and 81 for women. Doesn’t that mean that most of us should be taking Social Security with the early option? That contradicts most of the advice out there on this topic. That, ladies and gentlemen, is why Stocky is here for you. This is where it starts to get fun, and we can apply a little game theory (awesome!!!).

When to start Social Security?

Actually, once you reach age 62, the life expectancy of those still alive (and able to make the decision on Social Security) is 82 for men and 85 for women. This makes sense because you’ve survived to 62 so by definition you didn’t die before then (awesome insight, Stocky), and those early deaths pull down that initial life expectancy model.

Since women are better than men as a general rule (Foxy Lady took over typing for just a second there), let’s look at this decision as a 62 year-old-woman. She needs to make a decision on when to take Social Security. She knows her life expectancy at this point is 85, which means there’s about a 50% chance she makes it to 85. So the worst choice for a 62 year-old is to take the early retirement option. She’s probably going to live long enough that either full retirement or delayed retirement is the better option.

At 62 she does the smart thing, and decides to wait. Her next decision comes at age 67, assuming she lives that long (there’s about a 5% chance she’ll die during those five years). But a similar thing happens—when she was 62 her life expectancy was 85 (right on the border of picking between full retirement and delayed retirement), but now that she’s 67 her life expectancy jumps up a year to 86. So if she makes it to 67 then she’s better off taking the delayed retirement (of course, there’s about a 4% chance she’ll die before she makes it to 70).

That’s a little bit weird though, isn’t it? It kind of feels like you’re that horse with a carrot dangling over his head, keeping him walking forward. It’s a bit of a conundrum. At any given time, you’re better off delaying starting your Social Security, so the math tells you to keep waiting and waiting. But if the dice come up snake eyes and you die, then you miss out on everything (not strictly true, but true enough for our analysis).

And keep in mind that since Foxy Lady hijacked Stocky’s computer, we’ve done this analysis for women. The math tells you that it’s just about a wash between taking Social Security at 67 or 70. Since women live on average 3 years longer, for men you would think it means that the advantage leans towards taking it early.

What does it really matter?

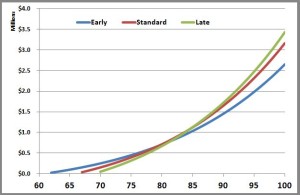

So the analysis tells us that we’re better off waiting if you’re a woman and it’s really close if you’re a man. And of course the longer we wait, the further we come out ahead by taking delayed retirement instead of early or full retirement. But how big of numbers are we talking?

Remember, the cut off for when full retirement becomes better is at about 80 years old. The cut off for when delayed retirement becomes better is about 85 years old.

| Future value of Social Security payments | |||

| Age | Early retirement (62) | Full retirement (67) | Delayed retirement (70) |

| 85 | $1,031,256 | $1,119,603 | $1,125,233 |

| 90 | $1,450,231 | $1,644,630 | $1,716,663 |

| 100 | $2,647,751 | $3,158,200 | $3,431,844 |

Those are meaningful differences. If you make it to 100 years old, delayed retirement comes out about $800,000 higher than early retirement. However, those are in future dollars, 38 years into the future if you’re 62 today and faced with this decision. That $800,000 when you’re 100 would be worth about $370,000 today. Of course that’s if you make it to 100, which isn’t really likely (about a 3% chance).

If you make it to 90 years old (you have less than a 30% chance) then the difference is about $260,000 in future dollars which is about $150,000 today.

Wrapping up, I’m really torn on this. There’s a little bit of a prisoner’s dilemma type thing working that keeps making you want to push back when you start collecting. And then when you look at the upside of delaying retirement, the numbers are pretty big (whenever you’re talking about hundreds of thousands of dollars, that’s real money), but the chances of us making it to that super-golden age are pretty small.

I suppose it’s best to wait, but I’m giving that a pretty “luke-warm” endorsement. It certainly isn’t the “slam dunk” that so many pundits make it out to be.

Actually, I think the way the Social Security administration sets it up, the options are all pretty similar. We all have this personal belief that we’ll live longer than average (but not everyone can live longer than average, expect if you’re from Lake Wobegon, MN). And that makes us think we’re better off waiting, but it probably is all pretty equal.

I retired at 60. I will tell you how I made my decision.

First idea is take it early and invest the proceeds, since I did not need the income. Most people will never do the investing, the money will just get spent monthly. Just like getting an extra 100 a month in your paycheck instead of a 1200 IRS refund at the end of the year. It will get frittered away.

Second idea is to look at a possible negative future. What if my investment outcomes are way less than I anticipate? Decision. I take mine at full retirement age. Spouse at 70. If I expire before her she gets maximum amount. If she leaves first I get max amount as a widower. Our pre retirement incomes were very similar. After we both start drawing SS will be over 70K a year. If I am wrong and we both leave early it will be our gift to the American taxpayer.

A secondary benefit. We can choose to show 0 income for 5 years. Living on savings. The ill advised tax cut yields more benefits. We can convert 100K per year from IRA to a ROTH. Taxes will be less than 9%. Now ROTH money can continue to grow for the rest of our lives tax free with no RMDs ever. Tax free if we do take it out.

I have every confidence SS will pay out. Someone has predicted its demise every year I have been an adult. Congress may try to screw up ROTH accounts. I bet it will be grandfathered.