“If stocks didn’t go up and down, which way would they go?”

The sheer volume of information related to the stock market is truly staggering. Everyday newspapers like the Wall Street Journal, Financial Times, and many others fill countless pages of copy on this topic. Similarly, cable channels like CNBC, Bloomberg, and many others spend countless hours with their talking heads telling viewers why the stock market acted the way it did today and what it will do tomorrow.

It’s easy to get overwhelmed by all of this. You don’t know whether you should be doubling down on Chinese internet stocks or selling everything because Russia is about to start World War III. As a long-term investor, I try to stay above the fray and keep to my buy-and-hold strategy. However, it’s always good, and maybe even a little fun, to look at the big news stories of the week and see if they really do justify the crazy movements of the stock market. I think what we’ll see is that the news events are way too small to justify such large swings in the stock market. Let’s find out.

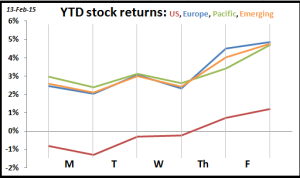

Every Friday I am going to write a blog giving my take on the week. I’ll always show the chart above, so let me orient you on it really quickly. This shows the year-to-date returns for ETFs which represent the US stocks (VTI) in red, the European stocks (VGK) in blue, the Pacific Rim stocks (VPL) in green, and emerging market stocks (VEA) in orange. So looking at the US stocks, they started the week down 1% from where they started the year, and over the course of the week they increased about 2% to end the week up 1% from where they started the year.

The biggest stories this week were: Apple worth over $700b (Monday), Tesla misses earnings (Tuesday), Greek bonds (Wednesday), Ukraine truce (Friday). These stories drove US and international stocks up about 2%.

Apple worth over $700 billion

This week Apple’s stock rose so that the entire company is worth $700 billion, a truly astounding number and an amazing success story. But this is more effect than cause. A couple weeks back Apple announced on its earnings call that it sold enough iPhones that every man, woman, and child in the world bought one (I may have exaggerated some figures). That’s the real story; Apple’s business is incredibly strong, and I think that speaks to the overall strength of the US economy—people are “splurging” on electronic toys and that must mean people are feeling good.

As a result of that amazing earnings, its market capitalization has risen to over $700 billion, but that’s really old news, good news for sure but old news.

Tesla earnings miss

Tesla is a media darling. It has super-cool and sexy products and its CEO, Elon Musk, is a super-charismatic visionary who has captivated the world. One day its technology might become the world standard, but that day is not today and it won’t be tomorrow or next month or next year.

So when Tesla only grows 45% and sells a mere 120 cars in China, what does it really matter? For every car that Tesla sells, GM and Ford sell thousands; while Tesla is an amazing story it is such a drop in the bucket compared to the giants of the auto industry. One day I hope that changes and my two cubs won’t need their driver’s licenses, but today when stories about Tesla move the market it just seems like the Texas saying “big hat, few cattle”.

Greek bonds

Have you ever seen a car wreck in slow motion? That’s what the Greek bond crisis seems like, and it’s going to go on and on and on.

Eventually, one of three things will happen:

- The Germans will force austerity and reform measures on the Greeks which will continue to depress their economy. Given that Alexis Tsipras was elected prime minster on the platform that he wouldn’t allow this, this doesn’t seem likely to happen in the short-term.

- The Germans will talk a big game but eventually give more relaxed terms to the Greek bailout package. This will kick the can down the road, and the Greeks will continue to be dependent upon the international community (kind of like the 26 year old still living at home and sponging off his parents).

- Germany and Greece won’t agree, Greece will default on its debt package, and they will ultimately leave the Eurozone. Germany will take its ball and go home.

At the beginning of the week it was #1, and then yesterday it was #2. It will flip flop about 90 more times before they kick the can down the road—Greece will get some relief but it won’t fundamentally change their non-competitive economy. Ultimately I think #3 is what will happen, but not for a few more years as they tear this bandage off excruciatingly slowly. And through it all, who cares? The world is getting super worked up over a country that has 11 million people with an economy about the size of Connecticut’s.

Ukraine-Russia cease-fire

A cease-fire was brokered, and for the investing community that seems like really good news. The Russian economy is a mess right now: mostly because of the low oil prices, but also because of the sanctions the world has placed on them. Also, wars are expensive, really expensive. Add all that up and there is a serious drag on their economy, an economy by the way that is about 15 times larger than Greece’s (and you know the tizzy everyone is in over the Greeks).

Hopefully this cease-fire will stick, but I suspect there will be a few false starts. However, if this cease-fire is the green shoots of the end of this conflict, then that will be really great for the stock market.

So there you have it—markets are up about 2% across the board for the week on mostly good news with a couple pieces of bad news which really aren’t that big of a deal. I hope you have a great weekend and pump some money into the economy this Valentine’s Day via Hershey kisses and 1-800-Flowers.