I’m trying to build my audience, so if you like this post, please share it on social media using the buttons right above.

For most Americans, their home is the largest purchase they will ever make in their lives, and it is their largest asset. A lot of people call a person’s home their largest “investment”. That begs the question: Is your home a good investment?

Definition of an investment

We need to remember what an investment is, particularly for this. An investment is where you pay for something and then either get payments, like a dividend, or you are able to sell it at some point in the future for a profit.

For houses, you don’t really get a periodic payment. That may be the case for rental properties which I’ve discussed here. But for this post, let’s assume you use your home for your personal residence. That means for the idea of an investment to work, you need to sell your home for more than you bought it.

Now that we have that out of the way, let’s figure this out.

Our story

A lot of times in personal finance, it’s better to be lucky that good. Foxy Lady and I were very fortunate when we bought and sold our Los Angeles house. It turned out to be an awesome investment (or so we have always thought, but let’s wait until the end of this post for a final verdict).

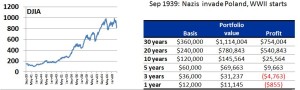

Shortly after we were married in 2010 we moved to LA. That was pre-cubs but we knew we wanted to start a family, so we bought a cozy 3-bedroom house for the low, low price of $785,000. What?!?!? Los Angeles real estate is insane.

In 2015 I retired and we moved from LA to North Carolina. As insane as housing prices were in 2010, they got even more insane in 2015. We were able to sell our house for $1,150,000.

Wow!!! That’s a heck of a profit. Definitely that shows that in our case, our house was an awesome investment. Not so fast. Let’s look at the numbers and really figure out how good of an investment it was.

Our $785,000 investment grew $365,000, so that’s a 46% increase. That seems like a really high return, but wait . . .

That was over 5 years, so on a compounded annual basis that’s about 8%. Still, that’s a really good return, but wait . . .

We did a fair number of home improvements to our house. When we bought the house there was a bit of water damage on one of the outside doors, so we replaced those plus a few of the windows. Plus we decided to paint the outside because it has a hideous white color. Also, we did a lot of landscaping work and had to fix the sprinklers. Let’s say all that came to $20,000.

Later in 2014, Foxy Lady completely redid the kitchen and bathrooms. It was one of her crowning achievements, and a bit of her died when we moved just a few months later. That all cost about $40,000. If you factor that in, then the return falls to 7%. Most people will take 7% any day, but wait . . .

We were really lucky in that we sold our house as part of Foxy’s relocation package for her new company. Normally, realtor fees are about 6% of the house’s selling price. That would come to about $77,000. Fortunately, we didn’t have to pay that, but under most circumstances we would have. Had we factored that in the return falls to 5%, but wait . . .

Then there were other costs like property taxes (about $10,000 annually) and regular repairs like when we had to replace our dishwasher (let’s call that $3,000 each year). If you factor that in, the return bottoms out at about 4%. That is a far cry from the 46% we originally had in our head.

Maybe we’re being too pessimistic. There’s some upside, right? Sure there is. It did act as shelter for us. Let’s say it would have cost us $4,000 per month to rent a place like that. In a way that acts like a bit of a dividend; owning that house gave us $4,000 of value each month. That is a huge factor which has a major impact, raising our return from 4% to over 9%.

Plus, on the upside, selling your home has some nice tax advantages depending on the circumstances. If you owned the house and used it as a personal residence for at least a couple years (to avoid flippers), then any profits on your house up to $500,000 ($250,000 if your single) are not taxed. If you had profits for stocks those would be taxed like a capital gain whose rates are around 15-20%. That is actually a pretty ENORMOUS advantage. In our case, we had a profit of about $300,000 after you accounted for the home improvements we did; a 20% tax rate would have come to $60,000. As it was, we didn’t pay any of that.

Looking to the data

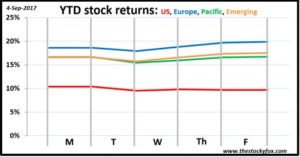

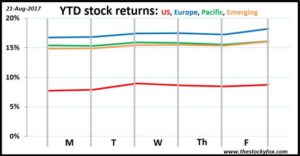

We had our story, but I have this nagging feeling that we got fairly lucky with the house. Imagine an investor whose only experience with stocks was buying in 2012. They would have had a annual return of about 11%. Hopefully they would have the perspective that that isn’t normal for most investors over most periods of time, and they just happened to have really lucky timing.

For housing it’s a bit tougher to figure that out. In the stock market we have all sorts of data that bloggers (whose kids just went back to school, so they have more time on their hands) can parse a million ways. Not the case with housing.

First, there’s just not that much data out there. Second, the calculation becomes complex for all the reasons we discussed in our situation. You have to control for things like home improvements, repairs, etc.

That said, my BFF Robert Schiller in all his smartness has the authoritative data on the subject. Going back to 1950, the same year the S&P 500 started, housing prices have increased 0.4% annually. That seems crazy low. We know that houses are more expensive now than they were back then. Did the Nobel Prize winner get it wrong?

No, he got it right. That 0.4% is the increase if you hold everything else constant. Since 1950 houses have gotten a lot bigger, made with better materials, with more features, and all that stuff. Using some hard-core statistics, you can strip all that stuff out and find out how much the house on it’s own increased in value. That number is 0.4% annually.

Just in case you were wondering, the S&P 500 has increased 11% annually since 1950. BOOM!!!

During that same period of time that we owned the house, stocks were up over 12%. Granted, that was during a decent market run, but that kind of makes it apples to apples comparing that to a really strong run for California real estate. Just from a numbers perspective, it would have been better for us to rent and put all that money into the stock market than what we actually did.

Putting it all in perspective

9% seems like a huge return for our house (4% if you just count the house), given that I typically use 6-7% as my expected return for stocks. That should be a vote in the “yes” column for the question: “Is your house a good investment?”

However, based on the data it seems like we had really, REALLY good timing. If normally houses appreciate 0.4% when you strip out all the other stuff, then our experience where we got a 4% return seems like a major outlier. Conversely, stocks had a return of 12% when they historically have a return of 11% or so. We could debate which was MORE lucky, but I definitely think the appreciation of the house was a greater outlier.

What does it all mean? Houses tend to appreciate about 0.4%, but if you include the value it provides as shelter while you hold it as an investment, maybe that bumps it up to 5% or so. It also has favorable tax treatment so those are all really attractive.

However, stocks on average return about 8% per year. So even with the tax benefit, ON AVERAGE (which is a crazy term in and of itself), houses aren’t that good of an investment compared to the stock market. Even in our case, where we had an awesome run with our house, the stock market did better.

Does that mean that we should never buy a house, only renting and then using that money in the stock market? No, I don’t think so. There are really good reasons to buy a home beyond the investment angle.

In my opinion, the most important element is self-determination. I weighed the pros and cons of home ownership here, and the one thing that transcends money is when you buy a home you control your future. In that post I mentioned how our neighbors who were renting didn’t have their lease renewed and had to move. Also, people who rent don’t tend to upgrade their house to make it as nice as they want. Those are important considerations that, at least for us, tip the balance towards homeownership. But what doesn’t make a very compelling argument is the fallacy that homes make great investments.