“Little pink houses for you and me” — John Cougar Mellencamp

The decision to rent your home or buy your home is one of the biggies. For those who buy, their house is often times their single largest investment. For those who rent, that is usually the largest single monthly expenditure. Obviously this is an extremely important financial decision in most peoples’ lives.

Yet as important it is financially, this decision tends to get steeped in emotional issues. Homebuying is a bit of a rite of passage—when you buy a home you’re buying into the American dream, you have arrived, you’re investing in your community, etc. There is some merit in those ideas, but they’re mostly just dripping with emotional sentiment. After all, why can’t you invest in your community if you are renting?

For this post, I want to look at the choice from a purely financial perspective. And what better way to do that than break it down Dr Jack style? Just to put a little meat on the analytical bone, let’s assume we have a home that we could buy for $400,000 or we could rent for $2000 (I did a quick search on Zillow in a few different markets and this seemed reasonable).

UP-FRONT COSTS: When you rent, you have to give a deposit which is typically something like one month of rent, so that’s $2000. Not a big deal in the grand scheme of things. When you buy, your down payment is in the range of 20% (or maybe even higher since the 2008 financial crisis—the Fox family had to put 25% down on our house). That would mean $80,000 if you’re buying.

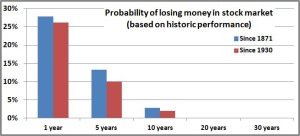

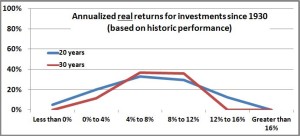

At first glance that may not seem like a big deal because it’s still your money, it just happens to be “invested” (did you notice how I used quotes there?) in your home. However, when your $80,000 is tied up in your house you can’t invest it (no quotes there) in the stock market. Since the stock market historically returns about 6% that means you’re passing up $4800 per year on average. Over an investing career that ends up being a TON of money.

Advantage: Bid advantage to RENTING

MONTHLY PAYMENT: The most common knock I hear on renting is “every month you pay rent, you’re throwing that money away.” I hate that comment, and part of this post is to show how little sense that makes. Obviously when you are renting, your monthly payment is your rent, $2000 in this example.

When you buy, your monthly payment is your mortgage (here we aren’t going to include insurance and taxes, that will come later). If you have a typical 30-year mortgage, let’s say at 4% interest, your payment is going to be about $1530 per month. That’s quite a bit less than you’re paying in rent, so obviously that’s an advantage for buying, but then there’s another little bit of good news. That $1530 you’re paying is mostly interest, but a small amount is going towards paying down your loan. In a way that can be seen as you “saving” money. In this example the amount going towards you’re loan would be about $200 per month. So that’s pretty nice.

Of course, that means that about $1300 per month is going to interest. So when people say that you’re throwing away your rent, can’t you say the same thing for the interest on your mortgage? Either way, this is definitely an advantage to buying.

Advantage: BUYING

OTHER COSTS: With renting, once you pay that rent check, you’re pretty much done. With buying you have a lot of other expenses that nickel-and-dime you to death. Property taxes have to be paid (let’s say 1% of the property value so that’s $333 per month). If you live in a condo complex or an association you might have monthly dues that could range from pretty minor to a significant chunk of money (when the Foxes lived in a condo in downtown Chicago, our monthly association fees were $900 per month—ouch!!!). Those can definitely add up, so that’s a nice advantage to renting.

Advantage: RENTING

TAX ADVANTAGES: The government has voted with its wallet that homeownership is a good thing, and they show this by providing HUGE tax advantages to homeowners that aren’t available to renters. Typically, your mortgage interest and your property taxes are tax deductible. As we know, being smart with taxes is one of the best ways to really turbo boost your portfolio, so this is a big deal. In our example, if you assume a 35% tax bracket, the tax deduction equates to about $580 per month. If you’re renting you don’t get any of that.

Advantage: Big advantage to BUYING

INFLATION: Once you buy your house your biggest cost, your mortgage, is going to stay put. We’ve talked about inflation before, and the enormous impact that even a little inflation can have on expenses after many years, so this seems pretty awesome that you don’t need to worry about it for your biggest expense.

With rent “that’s where they get you”. Rents almost always go up. Often there are laws that put a cap on how much they can go up, 2% seems a number I’ve heard before, so that provides some relief, but even that 2% can be a big deal. If today your rent is $2000, in 10 years it would be $2440, in 20 years it would be $2970, and in 50 years it would be $5390. That sucks, especially when compared to buying where your mortgage payment will always stay the same.

Advantage: Big advantage to BUYING

SELF-DETERMINATION: A neighbor was renting a few houses down from us. The family loved the house, loved the neighborhood, loved the neighbors (of course they did). But one day the landlord called her and said she wasn’t renewing the lease because she (the landlord) was moving into the house. That family that was renting was FORCED to move even though they didn’t want to. That sucks.

When you rent, you’re definitely at the whim of your landlord. If you buy, you are in control of your own destiny, baby. Get drunk off that power.

Advantage: BUYING

UPKEEP: One of the super-nice things about renting is that you don’t need to worry about when things break down. If there is a problem with the toilet, call the landlord. Water damage from the really bad storm, call the landlord. Fridge on the fritz, whatever—call the landlord. In general this is an awesome advantage. This is even better if you’re not a very handy person.

If you own a home, whenever anything goes wrong you need to fix it yourself (hence my “handy” comment) or worse you have to pay someone to fix it for you. There’s no perfect estimate, but a generally accepted rule is you should plan on spending 1% of the home’s value on maintenance. In our example that would be about $4000 per year.

Advantage: RENTING

NICENESS: As an owner, if you want to make your place nicer you absolutely can. If you want a pool, build it; hardwood floors, install them; custom closets, wallpaper, nice landscaping, and on and on. As a renter there’s a reluctance to do it because in some sense you’re paying to make someone else’s property nicer. If you rent there for years and years, maybe that’s not a huge deal, but that “self-determination” issue rears its ugly head.

I don’t have statistics on this, but I bet that most renters would love to make their place nicer, but just don’t because there is some deep attitude that you don’t do that when you rent. I totally get it and understand it, but it sucks that this keeps you from making your place as nice as it would otherwise be.

Advantage: BUYING

WORST-CASE SCENARIO: I’m not talking about your hot-water heater going bad or having to replace the roof (those we captured in “Upkeep”). Here I’m talking about real worst case scenarios like a natural disaster (in California earthquakes aren’t covered by most homeowners insurance policies; you can get earthquake insurance which is really expensive, so most don’t get it), or the neighborhood really turns bad, or termites or black mold infestations happen inside the walls. Let your imagination run with this for a second and you can really think of some nasty stuff.

As a renter, you can pick up and leave the nightmare behind. Just go somewhere else and start paying someone else rent, and problem solved. Not so if you own the home. Your single largest investment is at risk. Sucks to be you.

By its nature, the worst-case scenario isn’t very likely, but still it could happen. This is one of the things that keeps me up at night as a homeowner.

Advantage: RENTING

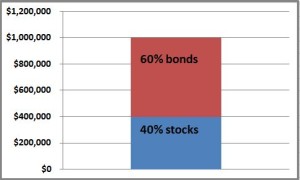

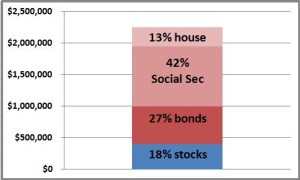

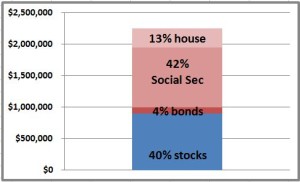

ASSET ALLOCATION: A mortgage is a “forced savings” program in a way. Every month you’re making a mortgage payment and part of that goes towards your equity that you can use as you get older (reverse mortgages, cash-out refinances) or pass on to your heirs. After 30 years your house will probably be paid off and you’ll have a tidy little sum of cash to supplement your portfolio. Also, because home values tend to be much steadier than stocks, in a way this investment might seem like a bond.

We saw how crazy important asset allocation is, so if you have a lot of home equity, that might make you feel more comfortable to put a bigger portion of your portfolio into stocks which historically have a higher return. This is a bit of a tricky one, but there’s definitely some level of advantage there.

Advantage: BUYING

REALTOR COSTS: There will come a time when you are ready to leave your current home and move somewhere else. If you’re renting this is easy (but not super-easy). Usually, you’ll wait for your lease to expire and then head on down the road. If you need to move right away and your lease isn’t up for a while, that can create a bit of a challenge of breaking you’re lease. That could be as easy as paying a penalty of a month’s rent, or your landlord could play hardball and hold you to your lease until the end. So this can be a pain, but more in the “moderate” zone.

When you own a home and have to sell it, that is a monumental undertaking. Getting a home ready for sale, listing it, showing it, and ultimately closing the sale can take months from beginning to end. Also, it’s not cheap. While realtor fees vary, they average about 6% of the home’s value. In our little example that would be $24,000. That is a lot of money. If you’ve been in the house for 30 years, that will amortize to less than $1000 per year, but if you’ve only been living there a few years that could be thousands of dollars per year that you need to tack on the to “Buy” expense column.

Advantage: Big advantage to RENTING

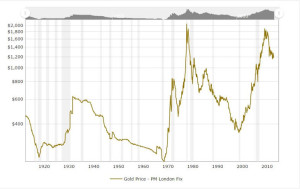

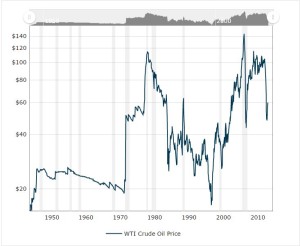

PRICE APPRECIATION: We saved the best for last, kind of. When you own your home, you get to take advantage of any price increases that your home experiences. Of course, if your home goes down in value, you suffer those loses too. However, like stocks, homes have historically increased in value over time, with notable exceptions like when home values crashed in 2008.

That’s great news, right? No question. However, it’s not as good as most people think. You hear all sorts of crazy stories about people making a killing off their house, but those tend to be anecdotes rather than the rule. The numbers are hard to come by but I think the most definitive and well-respected data, the Case-Shiller index (developed by my BFF Robert Schiller) shows that prices for existing homes have only increased 0.5% over the past 40 years after you account for inflation.

THAT’S CRAZY. That goes against everything we hear. How can that be? Well his index controls for things like home sizes getting bigger, houses getting nicer features, etc. So it really tries to do an apple-to-apples comparison of what you can expect will happen to your home. So home prices do tend upward, but just not at anywhere near the pace that we’ve come to believe.

Advantage: BUYING

|

Buy

|

Rent

|

| Investment return on down payment |

$400

|

|

| Interest/rent |

$1,333

|

$2,000

|

| Property taxes |

$333

|

|

| Tax advantage |

-$583

|

|

| Maintenance |

$333

|

|

| Realtor fees (5 years) |

$400

|

|

| TOTAL |

$2,217

|

$2,000

|

If you put it all together Buying “wins” it 7-5. But the math shows that Renting comes out slightly ahead on a monthly expense basis. Ahhhh, this is why the decision is so complex. Hopefully you saw my point that buying isn’t the unambiguously better option.

If you look at the numbers, it really breaks down to two major factors—realtor costs and price appreciation. The longer you’re in your home, the more years you can spread that 6% realty fee over. So if you’re planning on moving after a few years, that becomes a major disadvantage to buying. Your home appreciating in the icing on the cake that can really make the whole difference. However, the Case-Schiller index showed that prices don’t rise nearly as fast as everyone seems to think (hence, I didn’t even include it in the expense comparison).

It’s a tough call, so I’ll leave you with this. The Fox family owns our home, and it has turned out to be the best investment we’ve ever made. We bought in 2010 when the housing market in Southern California had been thoroughly thrashed by the 2008 crisis. In the past 5 years our home has rebounded, more than doubling in value. We would have missed all that had we rented, but if I’m honest with myself, it was just really lucky timing. Sometimes it’s better to be lucky that good.

Do you rent or do you own? What do you think?