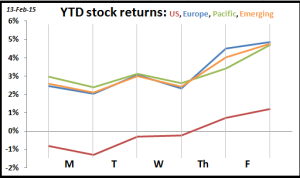

The biggest stories this week were: Greek debt restructure (every day), oil train explodes in West Virginia (Monday), US Federal reserve takes dovish tone on interest rates (Wednesday), and Wal-Mart raising wages for workers (Thursday). US stocks were up just under 1% while international markets were all up about 2%.

I’m no longer calling this a Greek drama—it’s more like a Greek saga or Greek epic. Monday everyone was playing nicely, Tuesday the Greek finance minister didn’t wear a tie and that insulted the sensibilities of everyone else, by Wednesday they seemed to be making progress again, on Thursday Germany rejected Greece’s bailout request, and today at the eleventh hour they agreed on a four-month extension which powered the US markets up about 1%.

Next week I’m writing an entire blog post on how this story is totally overblown and that it really doesn’t impact ordinary investors that much. Suffice it to say, similar to the weather, this story is going to change constantly (that weather analogy does not apply to Southern California where it’s pretty constantly sunny and warm—sorry all you people buried in two feet of snow). Greece bought itself some time, but you get the feeling they’re just kicking the can down the road. The media is going to continue to pound this story because it makes good copy, and the markets seems to be bouncing with it between optimism and pessimism. No way in the world the Greek economy is important enough to have this type of impact on the world’s stock markets.

I actually think this one has the potential to be a big deal. As the North American oil boom unfolds, the logistics of how to get the crude from North Dakota and Alberta to market are becoming increasingly important. Oil tankers on trains have carried most of the burden, and so long as projects like the Keystone Pipeline languish on the president’s desk, those trains are going to continue to need to do so.

The concern I have is that the oil tanker cars that exploded in West Virginia over the weekend were supposed to be top-of-the-line with enhanced safety features. Fortunately this time no one was seriously hurt, but there have been several of these accidents, some of which have caused loss of life, all of which have caused significant damage. Extracting oil from those shale fields has been one of the great economic success stories in the past few years (remember when gas was $4+ per gallon?). However, there aren’t enough people driving cars in North Dakota to use all that oil; it has to get to market somehow. If trains can’t efficiently, cost-effectively, and safely do it (do you see the picture of the fireball?) and regulators won’t approve pipelines, I have a concern that a real albatross might hang over the domestic oil industry. Transporting the oil is going to be much more regulated and a lot more expensive.

Accidents like this are just going to continue to highlight the dangers, and even if the accidents are happening less than 1% of the time, can you blame people for getting concerned? I mean, it blew up the side of a town.

The US Federal Reserve released its minutes and seemed to indicate that it was leaning towards raising interest rates later rather than sooner. The equity markets increased a little bit, but bond prices shot up like a rocket.

Everyone agrees that interest rates will have to go up (which tends to lower stock and bond prices). What is up in the air is when those rates will go up, and today’s news said we’ll still have the lower rates a little while longer, confirming what it seemed most were expecting.

Surprise move from Wal-Mart, one of the most reviled companies in terms of worker compensation. The major debate is asking if they did this because:

- The economy is strengthening and they need to pay workers more to attract and retain the best people. If that’s the case this is pretty unambiguously great news for the economy, although it could be a sign that inflation pressures might be returning.

- Political and social pressures finally compelled Wal-mart to pay its people more. If this is the case, it’s either good news or bad news depending on where you sit on the political spectrum.

- Wal-Mart’s culture in its lower ranks is so soul-crushing that they needed to do something to shore up people’s spirits just do they don’t actively try to sabotage the company while at work. If this is the case, that’s really, REALLY bad for Wal-mart.

Either way, the market didn’t think this was good news for Wal-Mart. The stock was down over 3% on a day when the market was pretty much flat. My take is of the three reasons above, it’s closer to #2 than #1, probably about 1.8, with just a smidge of #3 sprinkled in. Wal-Mart just increased its cost structure about $1 billion without a corresponding increase in revenue, making it a loss of about $1 billion. If this is a populist pay increase (reason #2) which spreads through the economy, I think it will hurt other stocks the way it hurt Wal-Mart’s Thursday. So it will be interesting to see how other companies who employ a lot of low-skill, low-cost workers like McDonald’s who have been in the “minimum wage” crosshairs react.

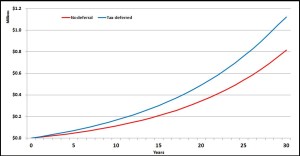

Have a great weekend. I’ll be posting my book review of my absolutely favorite book on investing tomorrow so be sure to check it out.