My neighbor’s son, Rhino, just got engaged (I dubbed him rhino because the rhinoceros beetle is the strongest animal in the world pound-for-pound, and this kid is really strong). We’ve gotten to Rhino over the years. He was Mini and ‘Lil Fox’s first babysitter when we moved into the neighborhood, so of course he has a special place in our hearts.

We were talking about his engagement, starting out life, and obviously since it’s a conversation with me, how to do the right things financially.

It got me to thinking about what are the most important things to do in the world of personal finance when you are just getting started. For the soon-to-be newlyweds, here is my Top 5 list:

5. Figure out your debt situation: If you’re lucky, you won’t have a lot (or any) debt. For most of us there is some out there, and that isn’t necessarily a bad thing. List out every debt you have (student loan, mortgage, credit card, car payment, etc.), the balance, and the interest rate.

On a spreadsheet (see #4) rank them in order of interest rate. As a general rule I use a cutoff of about 6%. If your interest rate is above that pay those off right away, starting with the highest interest rate debt first. If your interest rate is below that, that might be okay to keep that debt and just make the normal monthly payments.

If you have any debt (especially credit card debt) at any rate higher than 10%, that’s a “debt emergency”. Really look at every purchase you make—if it’s not critical to your survival (food, shelter) then pass that up until your debt is paid off. The only exception to this is #1—funding your 401k.

You can get creative with your debt by consolidating high interest rate cards onto a lower rate card or one that offers a low teaser rate. That could save you a ton of money, and you should probably look into that, but ultimately, you’ll need to pay that sucker off. So just hitting the grindstone of paying off your credit cards is a must.

4. Make a budget on a spreadsheet: Take a spreadsheet and put a quick budget together that includes your income, your expenses, and the difference between those two. This can be simple at first (and it should be simple at first). Over time, you’ll add more and more sheets to the spreadsheet for things like your mortgage, investments, kids’ education, and other things.

But at the beginning, you need to get a sense of where your money is going. The budget will give you an aspirational view of this. After your budget is done, you can track your spending with a website like mint.com. This two-step process lets you figure where you want to spend your money, and then also look at where you actually spend it.

Of course, this is an iterative process, and as you close a month and look at your expenses, you can see if you’re spending more than what you budgeted. This isn’t a time to beat yourself up (being too hard on yourself is a sure way to stop looking at your finances closely, and that’s a REALLY bad thing), but a time to ask yourself why you spent more and if it was worth it.

As an aside, using a spreadsheet is a really good skill in general. I was really good at spreadsheets and it’s hard to overstate the incredible impact it had on my career, as well as the incredible wealth those skills gave me and my family. And really, my experience with spreadsheets started in college when I was creating a financial budget.

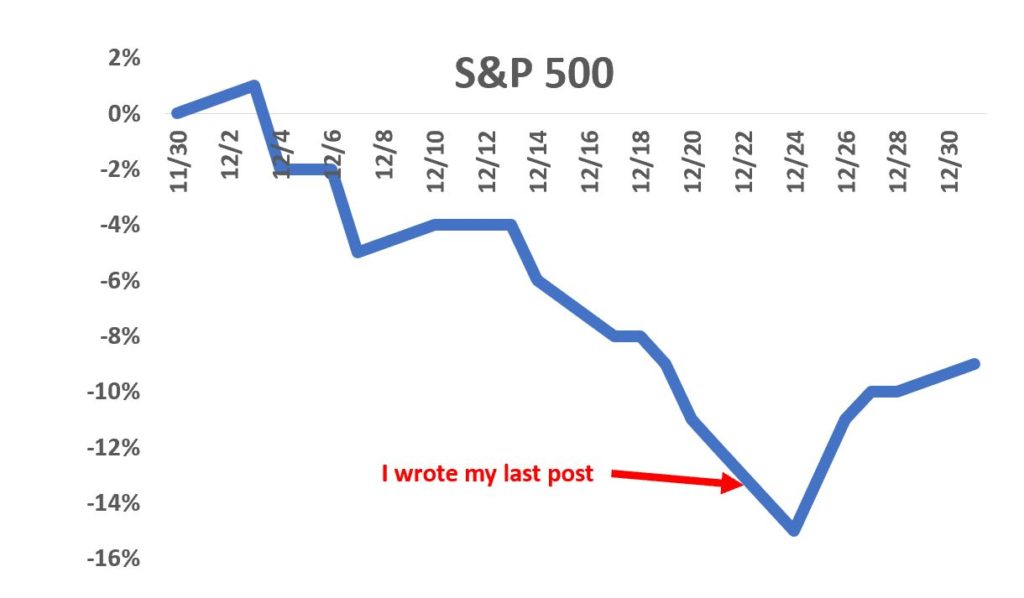

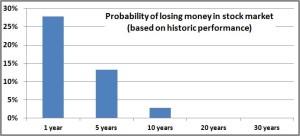

3. Educate yourself on investing: At a young age, educate yourself on investing. Obviously, this blog is the universally acknowledged best place to learn about investing, but I have heard rumors there are others.

www.mrmoneymustache.com is a great website that looks at personal spending and his early posts had a tremendous impact on my outlook. A Random Walk Down Wall Street is a book on investing that really defined my investing strategy; I read that as a 19-year-old and still think about its insights today.

There are a lot of websites written by millennials about spending and personal finance that might resonate even more. A few are: millennialmoneyman.com, moneypeach.com, and brokemillennial.com. Most are about reducing spending and budgets and that sort of thing, but there are some on the nitty gritty of making investing choices. You’ll want perspectives on both.

The whole point is that you need to know what you are doing here. Spending 20 hours early in your life to figure out basics like asset allocation, tax avoidance, and fee minimization as well as a general attitude towards saving early can easily lead to hundreds of thousands or millions of dollars. That comes to about $50,000 per hour—not bad.

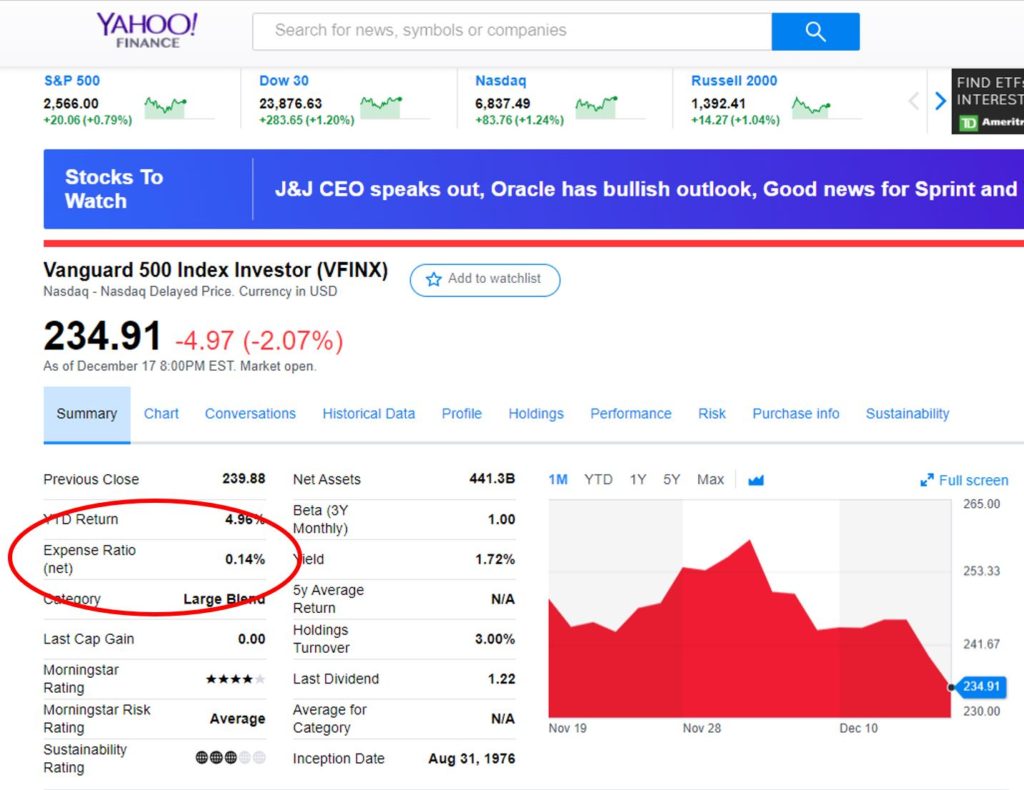

2. Start an IRA with $1,000: This is as much about the experience gained as it is about actually investing your money. Vanguard lets you start an IRA with $1,000 as the minimum amount.

You’ll navigate through their website, figure out how to make choices (like Roth or Traditional IRA—go traditional). You’ll pick your investments, and then you’ll have something to look at every once in a while to see how it’s doing.

So many people are just at a total loss when it comes to setting up accounts for their investments. That becomes a real problem once you hit 30 or 40 and you’re starting to get behind the 8-ball; you know you need to do something but are kind of clueless on where to start. Doing it now lets you get your toes wet in this world and makes the next accounts you need to set up (529, 401k, brokerage, etc.) all the less daunting.

1. Get the company match on your 401k: #2 was more for experience than for investment. Here is where you should start walking down the path for investments. At a minimum, contribute the match and take the free money.

This is so important for a couple reasons. First, you’re getting that free money. Second, you’re making your first “asset allocation” decision. When it comes time to pick which fund to invest in, unless you have very unique circumstances for an early-20s person, I would definitely go with a 100% equity index fund.

Third, your 401k is a really powerful tool. If you had no other investing tool, you could still grow a 401k to well over a $1 million during your working career. That is enough to fully fund your retirement.

BONUS—Stay poor: Too many young adults make a huge mistake of trying to mimic the lifestyle their parents provided, once they (the young adults) get out of school. That first paycheck of $2,000 is going to seem like a ton of money (and it is). It’s really tempting to decide to buy a new car or go on a kickin’ vacation or upgrade the furniture. Resist the urge.

Your parents took 25 or more years of working (with pay increases and investment returns) to provide the house and cars and vacations you enjoyed your senior year of high school. It’s not realistic to think you can have stuff at that level of niceness so early.

A car is a really good example. In general, automobiles are horrible investments. To the degree you have a car that can get you from point A to point B, keep it. A new car will be nice and cool and make your friends gawk, but it’s a horrible use of money. A couple hundred dollars a month for a car, plus insurance, and maybe $50 for a gym membership, $50 for cable, and $80 for four dinners at a restaurant—those numbers add up. Those alone could fund your savings in the early years.

Your early 20s are a time when it’s still okay not to have the best and nicest of everything. If you can embrace that, even when you do have the money, and put that extra money to work in investments you’ll build a very strong financial foundation that will afford you many more opportunities are you reach your 30s and 40s (remember, I did that and I retired at 36).