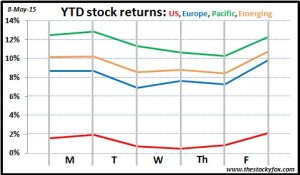

Talk about a whipsaw week. Most markets dropped about 2% by Wednesday only to mount a furious comeback and end up pretty much where they started.

This week is one of the really good examples of why I started these week-in-review posts. There was a ton of energy and excitement in the financial markets, starting out with doom and gloom and how everything is going to hell, with the markets falling accordingly. And then on Friday everything seems to be all better, so let’s forget all the bad stuff we thought was happening.

Weeks like this are classic illustrations of why a buy-and-hold strategy is such a good choice. You avoid all the distractions that come day to day in the market. Of course, I love all the day to day craziness just like I will enjoy watching the Bulls take on the Cavs tonight. However, in both cases, the events are pretty meaningless and a month from now we won’t even remember what caused all the excitement. But while we’re where, what did cause all the excitement?

On Tuesday the US Labor Department announced that worker productivity had fallen for the second quarter in a row. That coupled with reports that the US economy probably shrank in Q1 sent markets tumbling about 2% or so over the Tuesday and Wednesday.

Obviously GDP growth and productivity are the core engines of the economy and therefore of the stock market. So to here that some fissures are forming is certainly not good news and the markets reacted accordingly.

Wednesday Janet Yellen, Chairwoman of the US Federal Reserve, added to the stock market’s woes by saying that stock prices were “quite high”. It wasn’t nearly as colorful language as Alan Greenspan’s “Irrational exuberance” comment from the late 1990s, but it had the similar affect of rattling the markets.

But has there ever been a Fed Chairman/woman who said that stocks were low or fair-valued? They always seem to be predicting doom and gloom in a 30-year period that has shown an amazing track record for stock performance (actually “amazing” probably isn’t even a strong enough word).

Sometimes you get the sense that they just like to rattle the markets to show that they can. I imagine Janet Yellen telling Mario Dragi (her counterpart in Europe): “Hey, watch. I’m going to say something that will bring the markets down a percent or two. You should try it. It’s a lot of fun.” I’m totally kidding, but what is the point of her saying anything about the prices in the stock market?

Friday morning the employment report came out showing that the US economy added about 220,000 more jobs. So all is right in the world again. Wasn’t it just a couple days ago that we were all freaking out because economic growth and productivity were down? Plus Janet said stocks were too high. But wouldn’t you know it turned out they weren’t high enough, so stocks shot up 1.5% on Friday.

Seriously, this is why stock markets are like . . . . I don’t know what is a good analogy but the lesson here is definitely to not get caught up in the day to day gyrations. Hopefully you’re investing in your 401k and dollar cost averaging your other investments. You can enjoy the comedy of the daily market moves, and all the silly pundits that try to make sense of it all.

I hope you have a great weekend. And to all you mothers out there, have a wonderful Mother’s Day.