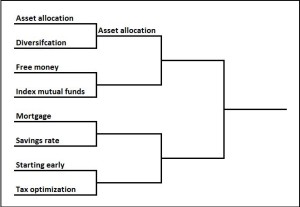

After a thrilling first day where we saw Asset allocation blow out Diversification, we are now on to day two where Free money will face off against Index mutual funds. As always, I am not an expert on these matters.

Reasons for picking free money:

Free money is . . . well . . . FREE. And obviously the more money you can contribute to your portfolio the closer you’ll be to retirement, the better you’ll be able to ride out stock market downturns, and the more financial flexibility you’ll have generally. I’m not telling you anything you don’t already know.

In the US, by far the most common opportunity for Free money is the company match for your 401k. Typically it looks something like they will match $0.50 for every dollar you contribute up to 6% of your pay. And there are some companies that are even more generous; Medtronic has historically matched about $0.90 for every dollar up to 6% of your pay. Do the simple math and your average 401k match comes in at about 3% ($0.50 * 6%). Ever since I started working in 1999 I have always contributed at least enough to get the entire company match.

If you do a quick calculation (assume you work from 22 to 60, with a salary that starts at $50,000 and rises to $100,000 over the years, with a 6% investment return), the value of that match is about $350,000. That’s not what your whole 401k would be worth, that’s just the value of the match!!! Not bad considering the median nestegg for a 60-year-old living in the US is about $140,000.

So who says no to this? Sadly, about one-third of employees who have access to a 401k plan are “leaving money on the table” by not contributing up to the amount that their employer will match. This is some really low hanging fruit that is going unpicked. I get that there is only so much money to go around, but man, every dollar you’re putting in gets you another $0.50 of FREE MONEY. That’s a guaranteed 50% return; there are a lot of investors who would give their first born for something like that (Foxy Lady just instructed me that I am not allowed to give away Lil’ Fox for a 50% return–damn).

Reasons for picking index mutual funds:

Index mutual funds are mutual funds that mimic an index like the S&P 500, Barclays Bond index, FTSE Global Cap, or the MSCI US REIT index. That may sound confusing—the point is these mutual funds find an index already established in the market and do their best to copy it exactly.

Index fund advocates, and I count myself among them with probably about 95% of the Fox’s nestegg in Index mutual funds, believe that these funds actually perform better than actively-managed mutual funds (an actively managed fund is one where the mutual fund manager picks individual stocks or bonds that he or she believes will out-perform the general market). I personally think the data here is mixed to slightly favorable for index mutual funds (mostly because of tax implications), but that is a pretty deep discussion probably for another blog post. For this analysis, I’ll assume that actively managed mutual funds and index mutual funds return the same amount.

The undeniable advantage of Index mutual funds is their lower management fee. Like all things, mutual funds charge a fee for their services; it is a percentage that the fund managers skim off the top to pay for managing the fund. For actively managed funds that fee averages to about 1% with some higher and some lower. This goes to paying for all the research done, salaries for the different teams, brochures and disclosures, travel to different conferences, etc., and it tends to be a pretty decent chunk of change. For Index mutual funds, you really don’t need all that because all the team is doing is tracking a pre-existing index; because of this management fees tends to be fairly low—in the 0.05% to 0.2% range.

Remember The power of a single percentage? We actually called out mutual fund management fees there as ripe for a 1% coupon. Running the numbers using the same scenario we just used for Free money (assume you work from 22 to 60, with a salary that starts at $50,000 and rises to $100,000 over the years, with a 6% investment return), that 401k account using a index mutual fund with a fee of 0.2% would leave you with about $990,000. An actively managed account with a fee of 1% would leave you with about $820,000. That a difference of $170,000 in your 401k over the course of your investing career.

But that’s just for one account. Index mutual funds can be used for pretty much all your investing accounts—401k, IRA, 529, brokerage. Also, they can be used throughout for investing career, from the time you open your first account as a youngster all the way through the end when you shuffle off this mortal coil and leave some cash to your loved ones (more cash than you would otherwise because you were paying lower fees).

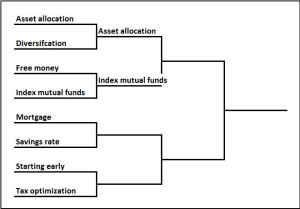

Who wins?

This turned out to be much closer than I anticipated. At first I figured that Free money would win this going away, but Index mutual funds definitely came to play. Free money has a power effect (about 3% of your salary on average), but that is generally limited only to 401k accounts, only to the first 6% of your compensation, and only while you are working. Even with all those limitations, it makes an enormous difference over your investing lifetime. Index mutual funds have a smaller impact but a much broader application. You can use them on every account, with every dollar invested, for every year you’re investing.

In a game that came down to the absolute wire, I think Index mutual funds barely edges out Free money in a Bryce Drew-style miracle finish. The final score, Index mutual funds 70, Free money 69. Ultimately I think Index mutual funds and that lower management fee will save more of your money in every corner of your investing portfolio, and that will ultimately lead to a bigger impact on your nest egg. I hope to see you tomorrow when your Mortgage takes on Savings rate.

im bias seeing as I work in the investment industry, but quality active management is worth the increased expense ratio, especially in down markets. With index funds you are guaranteeing yourself 100% of the downside.

There’s nothing wrong with being biased towards your company. I am definitely biased towards Medtronic. I hadn’t thought of the angle of managing downside risk–probably a lot of people appreciated that in 2008.