We’re ready to kick off the investing strategy tournament to determine which is the single best investing strategy if you could only pick one (which fortunately isn’t the case–you can pick all these). As always, I am not an expert. So without further ado, we’ll start with the contest between Asset allocation and Diversification.

Reasons for picking Asset allocation:

Asset allocation is picking the right mix of stocks, bonds, and cash which maximize your investment returns while also limiting that chances that you hit a bad patch of time which cripples your portfolio beyond recovery. The basis of the concept of asset allocation is the fact that as your expected investment returns increase, so does its volatility.

So for example, cash (or money market accounts) are the least volatile investments around where the chances of you losing money are nearly zero, but they also offer the smallest return at about 1-2%. On the other end of the spectrum are stocks which historically have averaged about an 8% return, but where about one-third of the years you lost money. Bonds are between those two, both in terms of returns and risk of losing money.

In my experience screwing up Asset allocation, especially among young investors, is one of the most common missteps. The conventional wisdom is that you want to take more investing risk when you’re younger because you have more time to “recover” from any market downturns (as was the case with me in 2001 when I was just starting out). That means that typically (and of course, each individual is different) younger people should allocate more to stocks than bonds or cash. However, so often I talk to younger investors who have a significant chunk of their 401k in bonds or worse yet, cash.

Why is this so bad? Well, over a period of decades, the investment horizon when you’re in your twenties or thirties, you end up leaving a lot of money on the table. Using historic averages, if the 25-year-old you invested your 401k in stocks and your twin invested in bonds, when it comes time to hang up the spurs, it’s no contest—you’re so far ahead of your twin. Remember that historically, stocks have returned about 8% while bonds have returned 5% and money markets (cash) have returned about 2%. Just doing some really simple math, the historic difference between stocks and bonds has been about 3%–that adds up to huge differences over an investing career (remember from “The power of a single percentage” how big a difference 3% can make?). Who knows if it will be like that in the future, but based on history that could lead to hundreds of thousands or even millions of dollars over time.

Of course, you probably read A Random Walk Down Wall Street, so maybe you’re saying, “but when you invest in stocks you’re only getting a higher return because you’re talking on more risk.” There’s no such thing as a free lunch, and right you are. That argument is exactly why Asset allocation is so important. If you were 60 years old and getting ready for retirement, it probably wouldn’t be a good idea to risk losing a big chunk of your portfolio by investing the majority of your money in stocks. But if you’re 20 or 30 years old, then you can invest in stocks to get the higher return knowing you’re at less risk of a catastrophic loss because you have three or so decades to ride out any storms.

Reasons for picking Diversification:

Diversification is the strategy of picking multiple investments so that you can reduce the volatility of your portfolio. When some of your investments are down, others will be up. This is really Investment 101 stuff, and I don’t think you’ll find many legitimate investors who would not say it’s a good thing. But if you think about it, how much is Diversification really doing to help you achieve your financial goals?

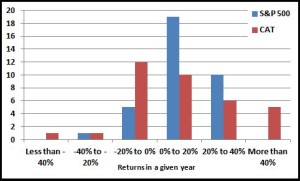

The fact of the matter is that Diversification does not increase your investment returns, on average (“on average” is a critical phrase here). If that’s true, then why does everyone make such a big deal about diversification? Because by diversifying with several stocks you even out the highs and lows that would occur with a single stock. As an example let’s look at investing in an S&P 500 index mutual fund which is considered highly diversified, and compare that to investing in a single stock. Here I picked Catepillar because from 1980 to today, it and the S&P 500 had largely the same performance (they were both up about 1000% over those 34 years).

Over that time both investments had their ups and downs, but the difference was that Caterpillar’s ups were much higher and its downs much lower. Since 1980 (34 years), the S&P 500 index had seven negative years with its worst year being 2008 when it was down 39%. It also had 11 years where it had a return of 20% or better with its best year being 1995 when it was up 39%.

Now compare that to Caterpillar over the same time, remembering that over the entire 34 years they both had total returns fairly similar to each other. Caterpillar had 15 years with negative returns, the worst being 2008 when it fell 55%. On the other side, it had five years where returns were over 55% (16% better than the best year of the S&P 500 index), with the best year being in 2010 when it increased 90%.

So think about that. If you decided not to diversify and put all your money in Caterpillar, you would have ended up in pretty much the same place as your twin who diversified with the S&P 500 index, but you would have had a much crazier ride. 2008 would have sucked for both of you, but much more so for you than your twin. Also, almost half of your years would have been negative (15 out of 34 years) where it was only about 7 out of 34 years for your twin. Of course, that would have been offset by some real “bumper crop” years (I had to get a farming analogy in) like 2010 when your portfolio would have almost doubled. No one is complaining about a year like that, but it that a good thing? How do you plan for something like that? Pre-2010 you were probably figuring you’d have a moderate retirement, and then 2010 rolled around and life all the sudden got a lot sweeter. Just look at the graph—far and away the most common annual return for the S&P 500 index was the 0-20% bucket; for Caterpillar the returns were all over the board and the most common was -20% to 0%–a loss!!!

And of course, I picked Caterpillar because over the 34 years it was pretty close to the S&P 500. Remember that if you picked a single stock randomly from a broad index like the S&P 500, you would expect the stock to do just as well as the index, because the index is just an average of a bunch of those stocks. And it’s true that on average a single stock will do as well as an index, but what if I randomly picked United Airlines which went bankrupt just like many, many other companies do every year (there’s no real chance that the value of the S&P 500 would go down to zero in a similar way)? Or if I picked Medtronic (one of the greatest companies ever) which outperformed the S&P 500 some 12x?

My personal preference with investing is that I want as much predictability as possible, and that is even tough to come by when you’re highly diversified; when you aren’t diversified, there’s no chance. Maybe if you like those types of thrills that putting everything into a single stock brings, you may want to think about BASE jumping or free diving.

But assessing it honestly, Diversification does not lead to higher returns on average. It just reduces the crazy swings up and down.

Who wins?

Asset allocation wins this one pretty easily, 86-59 (I just made that up to look like a basketball game score, but it seems about right). Diversification definitely helps smooth things out, but Asset allocation can undeniably increase your returns which translates to real money.

So Asset allocation moves on to theFinal Four. Make sure you come back tomorrow to see Free money take on Index mutual funds.

5 thoughts to “Elite eight: Asset allocation versus Diversification”