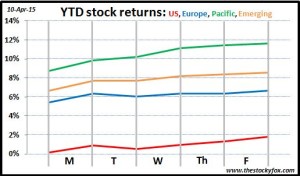

It seemed like a pretty boring week for the markets. We didn’t have a single day where indicies were up over 1%, which is a pretty serious departure from the roller coaster ride we’ve been on the past several weeks. All that said, when you look back on things we’re up across the board: 2.9% for Pacific, 1.9% for Emerging, 1.6% for US, and 1.2% for Europe. First, let’s acknowledge that’s a pretty good week. What caused it all?

We have entered earnings season, with Alcoa in their traditional role kicking things off (Alcoa’s ticker symbol is AA so they are kind of like New Hampshire during elections, being the first to go). Alcoa had a mixed report, beating expectations on earnings but missing on revenue. That said, the general feeling in the market was that earnings were coming in strong due to a generally positive direction for the economy.

In the past several week-in-review posts, I’ve covered all sorts of things from natural disasters to terror plots to geopolitical crises to business restructuring. But one thing I haven’t mentioned a lot is earnings. Earnings are the fundamental ingredient in investing, and I’ve been waiting for earnings season to kick off to really hit this topic. Everything else is background noise compared to earnings. Remember, when you buy stocks, you’re really buying a slice of the companies’ earnings; the bigger those earnings are the more your stock is worth. Over the next couple weeks as more companies report, we’ll definitely be looking to see how all this impacts the markets.

Mergers, mergers, everywhere:

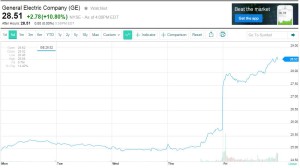

This week was dominated by merger, acquisition, and restructuring news. On Monday Federal Express announced its intention to acquire TNT Express, a Dutch parcel service; the stock for TNT rose 25% on the news. On Wednesday Shell announced a $70 billion purchase of BG, making this the biggest merger in the energy sector since Exxon and Mobil merged in 1998. BG was up 35% on the news. Finally, on Friday GE announced it would divest its $27 billion finance/banking arm; GE stock was up about 7%.

So lucky you if you were a TNT, BG, or GE shareholder. Doing back of the envelope calculations, those stock increases equated to about $30 billion in new value. That’s a lot of money, but given that the US stock market alone is worth about $19 trillion, that’s really a small drop in the bucket. So why do the rest of us care that three companies were bought at substantial premiums?

First, this isn’t the first time we’ve mentioned this. It seems we’re having a lot of mergers/divestures lately. Is that a good thing? I say “yes”. When these things happen you can see that substantial premiums are paid. That means the buyer thinks they can do better with the company than is currently happening. Certainly it doesn’t always happen that way, but going in that’s the plan. That’s a good thing right? People are putting their money where their mouth is, saying they can drive more efficiency, more sales, more profits from assets. As an investor, that’s your lifeblood.

Just looking at these three you can see it:

- FedEx and TNT do largely the same business in different parts of the world. If they combine their forces, wouldn’t they be much more efficient while also providing more streamlined service than two separate companies?

- Shell and BG are coping with a world where oil prices are down 50%. Doesn’t combining allow them to cut costs by eliminating redundant functions, allowing both companies to be more profitable than if they were separate?

- GE has long succeed as a diverse conglomerate, however, they were severly hobbled by the 2008 financial crisis. Does it make sense for the industrial arm to focus on “making stuff” and spin the financial arm off to someone who can focus on being really, really good bankers?

Maybe we’ll look back on these moves as inspired, or maybe they’ll earn places in the merger “Hall of Shame” along side Time Warner-AOL or Boston Scientific-Guidant. But coming out of the gate, you can see the potential for value, and those at the center of it all are betting billions on their ability to bring that value to reality. So I think this is definitely a good thing for the markets, and one of the justifiable reasons for the uptick in stock markets.

Have a great weekend, and I’ll see you on Monday when I post about an “Inflation Killer”.

One thought to “Week in review (10-Apr-2015)”