“Nothing ventured, nothing gained”—Benjamin Franklin

That Benjamin Franklin guy was pretty smart. This is the second time one of his quotes have landed on this blog. Now that you’ve entered the world of investing, you need to figure out how you balance the two fundamental, opposing forces of investing: risk and reward. At its simplest, investments compensate investors who take on greater risk with higher returns.

Think of the least risky investment you could make—a savings account. You could invest your money and know that your investment won’t lose money. You could take out the money in a week, a month, or a year; and you would get your original money plus a very small amount of interest. In the US, the risk of you losing money on this investment is 0%. Unfortunately, because there’s no risk, the “reward”, the interest you make, is extremely low: less than 1% currently.

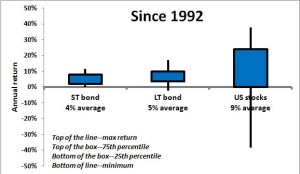

Let’s take a small step up the risk scale—short term government bonds. The chances of you losing money investing in a 1-5 year treasury bond (let’s assume you invest in a short-term bond mutual fund like VSGBX), are extremely low, but it isn’t 0%. There is a chance, albeit small, that changes in the market (interest rates) could decrease the value of your investment. You’re taking on a little bit of risk (since 1988 there has never been a year where VSGBX has lost money), and to compensate for that risk these investments historically tend to return about 1-2%. So you’re being paid a larger return than your savings account because you’re taking on more risk.

Take another step up the risk scale and you get to long-term government bonds and corporate debt (using a mutual fund like VBMFX). These are riskier because there is some chance that you won’t get paid back; this is true for corporate, foreign, or municipal debt. These are also riskier because like their less-risky cousins, the short-term bonds we just mentioned, long-term bonds can change in value due to changes in things like interest rates. The difference with long-term bonds is that the effects are magnified; so if interest rates go up, that would cause the value of your short-term bonds to go down a little, but the prices on your long-term bonds would go down much more. As you would expect, since long-term bonds are a little riskier (since 1988 VBMFX has lost money in 2 years), they tend to return a little more, historically in the 3-5% range.

Now, take a big leap up the risk curve and you get to stocks. Stocks are extremely volatile, especially over the short-term. Since 1930, there have been 24 years (about one-third of the time) where US stocks have decreased in value. It’s definitely a rollercoaster ride. Yet, by bearing the risk that in any given year your investment might go down in value, sometimes down a lot like in 2008 when stocks went down 37%, you get a significantly higher return. Since 1930, stocks have returned on average about 8%.

As you can clearly see in the chart, when you invest in assets with higher average returns (like stocks) you have a lot more volatility in those returns from one year to the next. When you invest in assets with lower average returns (like bonds, especially short terms bonds or even cash), you enjoy much more stability in the value of your investments.

What’s your appetite for risk?

As an investor you need to determine what your appetite for risk is. How will you balance the yin of high returns with the yang of higher risk? At the end of the day, you need to have an investing strategy that allows you to sleep at night. There’s no amount of money that’s worth freaking out every time the market takes a down turn, and it is certain that the market will take down turns. Sometimes it will be a free fall like in 2008 when stocks cratered 37% or it might be a long-term grind like from 1973 to 1978 where stocks fell 23% over the course of 5 years.

That said, a long time horizon is your best friend when dealing with a volatile stock market. While any given year might be crazy, over time there tends to be more good years than bad. Take 2008: in 2008 stocks fell by 37%, and if you needed your money at the end of that year you were hurting. On the other hand, if you had a longer-term investing horizon and were able to stay in the market, all your money would be made back by 2012. In fact, while about 33% of the years have been down years for stocks since 1930, over that same period of there was only one decade, the 1930s, when stocks were down.

So how do you invest? Well, you need to figure out your risk tolerance. Here’s a good way to do that. Imagine yourself as an investor at the end of 2008. You’re in the depths of the financial crisis, stocks are down 37%, and pundits are saying we may be on the brink of financial collapse. What do you do?

Some people like Warren Buffett and Stocky Fox (for important statements I revert to the third person) looked at that as an opportunity to continue to invest in stocks, just now we were buying them at a substantial discount compared to 2007’s prices. In the end our faith was rewarded and we made a killing. However, there were some times when the news just kept getting bad and Pepto-Bismol came in extremely handy.

Others felt burned by the 2008 investing bloodbath and pulled their money out of the stock market to put it in safer investments like bonds or cash. They did so knowing their actions limited their potential for higher returns, but many were willing to accept that if it meant not having to risk their money continuing to disappear into the black hole of the financial crisis.

There’s no right or wrong answer. You just need to figure out where you’re comfortable and invest accordingly. If you’re willing to weather the storms then you should probably invest more in stocks. If you’re more risk averse, then you should probably invest a larger portion of your portfolio in bonds.

Just remember, there’s no such thing as a free lunch. With higher returns come higher risk. If you want safer investments, you have to be willing to give up higher returns.

Hi StockyFox,

Thanks for another great post! Really enjoyed it!

I wonder what would you suggest – which part of my income/savings should be invested in the low-risk instruments and which part should be invested long-term, more risk? How should a person or a household determine that? I have read some articles on the subject, most of them say that one has to have at least 6 month salary in cash available any minute, some money on low risk deposits and some money in long-term investments. What is your take on that for a person in mid-30s?

For someone in their mid-30s I would recommend an asset allocation with a lot of stocks (90% or more) because you have a really long time (30 years or so) to weather any storms that come.

As far as 6-months cash on hand, I don’t believe that’s a good idea. Actually, Wednesday’s post will cover that exact topic. Short version is that unless you are at high risk of needing to dip into cash like that (a very unstable job for example), the chances of you needing the money aren’t that high and the money you leave on the table by not investing it can be pretty significant.

Thanks for the question and keep them coming.