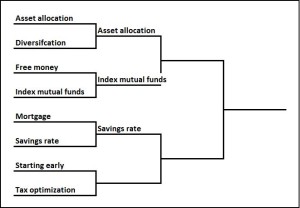

After a thrilling contest between Index mutual funds and Free money yesterday, we are now pitting Mortgage against Savings rate. As always, I am not an expert on these matters.

Reasons for picking mortgage:

For most families, their Mortgage payment on their home is the single largest expenditure they have. Also, due to its nature as a commodity, it’s also one of the easiest places to really save a lot of money pretty painlessly. For a lot of products there’s a trade off between price and quality. A BMW 325 owner could pay $20,000 less and drive a Honda Civic, but there is a trade-off, either real or perceived, between those two cars. Sure you’re saving a lot of money, but you’re also getting not nearly as nice a car.

Mortgages are very different because money is a commodity, so there’s no difference. If you get a Mortgage from Bank of America it acts pretty much identically as the Mortgage you get from Roundpoint (incidentally, the Fox family used to have our mortgage with BofA and now we’re with Roundpoint). Money is money so here you want to go with whoever can give you the lowest rate (there are some features that might be important like prepayment penalties or ability to refinance within a certain period of time, but in my experience those are pretty rare).

Here we’ll use the Grizzly family as an example; they owe $400,000 on their home. One of the easiest ways to save money on a mortgage is by refinancing when interest rates go down. In the past few years, rates have been at historic lows and that means Mortgage interest rates have been similarly low. Let’s say the Grizzlys got their mortgage 8 years ago with a rate of 6%, but now they can refinance at about 4%. That alone would reduce the interest payments over the life of their mortgage about $175,000!!! That’s an incredible amount of money for going through a process that takes maybe a month from beginning to end, and probably about 5 hours of work on your part. As easy as this is, there are millions of homeowners out there who haven’t done this yet.

You can move a little up the difficulty spectrum and save even more. Some Mortgages are sold with “points” which is basically prepaying interest; for example you might pay an extra $5000 when you get your loan and for that you would have an interest rate of 3.5% instead of 4.0%. Points aren’t very well understood and because of that a lot of people tend to stay away, but if you are planning on staying in your house for a long time, they can be the best money you ever spent. Using that above example, paying the $5000 to get the lower interest rate would net you a savings of about $35,000 over the life of the loan.

Kind of the opposite of points are adjustable rate mortgages (ARMs). Instead of a 30-year fixed loan (the interest rate stays constant for the 30 year life of the loan) you could get a 5-year ARM where the interest rate is fixed for the first 5 years of the loan and then adjusts based on market conditions for the remaining 25 years. The benefit of these is ARMs tend to be about 1% less than fixed rates, but the major concern is that rates could rise after the 5 years is up and that could increase the cost of your Mortgage. In my opinion ARMs make sense if you don’t think you’ll be in your home for very long.

In fact the Fox family got a 5-year ARM when we relocated to North Carolina. In the here and now we enjoy a rate about 0.8% lower than if we got a 30-year-fixed (our rate is 2.2% and it would have been about 3% with a fixed). That’s worth about $300 each month. Rates have been rising, so in 2020 when the ARM starts to float (rates can move) we can either pay a higher rate (remember, we’re still ahead of the game so long as rates stay below 3%), refinance to a fixed mortgage and pocket five years of monthly $300 savings, or just pay off the entire mortgage. We’ll see.

| What it does? | |

| Refinance | Take out a new loan at a lower interest rate to decrease the amount of interest you pay |

| Buy points | Pay more in closing costs to get a lower interest rate |

| ARM | Get a lower interest rate that is fixed in the beginning but then becomes adjustable (usually after 5 years) |

So all these seem to be pretty big numbers, especially since you aren’t really giving anything up to achieve them. But they aren’t going to be quite that big because interest on mortgages is tax deductible, so saving $100,000 in interest on the life of your mortgage may only put you ahead $60,000 because of the tax deduction. On the other side of the spectrum, you might end up with significantly more if you took those savings and invested them. Either way, your Mortgage is a great way to pad your nestegg.

Reasons for picking savings rate:

Savings rate is probably the most fundamental element of investing. You can’t really invest until you have saved some money to invest with (Gee Stocky, thanks for that tremendous insight into what we already know). And certainly, the more you save, the more you can invest, and the larger your nestegg will become. But how much can saving more really move the need?

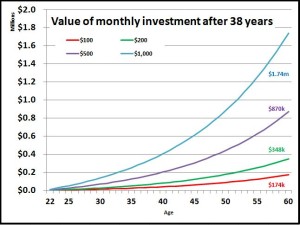

The impact can be pretty staggering. Over a 38-year period, from 22 when most of us enter the workforce, until we turn 60 and hopefully retire, if you invest $100 per month (assume a 6% return) you will end up with about $175,000!!! It’s not that $100 isn’t a lot of money (it definitely isn’t chump change), but that seems pretty incredible that such a modest amount every month can lead to such a large number at the end of the run. Over those 38 years, you would have invested a total of about $47,000, and because of investing returns you would have ended up with about 4 times that amount.

And the math works so if you save $200 per month, you end up with about $350,000; $1000 per month, you end up with $1.75 million. Ladies and gentleman, say “hello” to the power of compounding.

Who wins?

Mortgage gives it a good fight, but in the end Savings rate is able to generate numbers that are so much bigger. Also, while refinancing at a lower rate is a pretty sure-fire way to save money with your Mortgage, the more complicated maneuvers like buying points or using an ARM do entail some risk which could cost you serious dollars if you move too early or too late. On the other hand, there is really no way that saving more can hurt your nestegg. In the end Savings rate crushes Mortgage 65-51.

Come back on tomorrow to see the final match of the first round, Starting early against Tax optimization.