If you are a loyal reader, you’ll remember that two years ago this month we made a 5-digit purchase. Foxy and I installed solar panels on our new North Carolina house.

Two years later, let’s look at how that “purchase” has performed as an “investment”. To save you the suspense (Hey, I appreciate you’re busy and may not have the time to read this whole post), I’ll give the investment a solid mediocre to slightly below mediocre—about a 4% return.

Sweet, free electricity

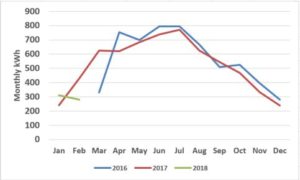

We bought an array of twenty 265-watt solar panels. At the time, when we were talking to the sales guy and we factored everything in—the number of sunny days in our area, the pitch and direction of our roof—we thought we were going to be getting about 550 to 600 kWh each month. As it turns out, we’ve averaged slightly less than 530 kWh per month.

That’s a bit of a miss that translates to real money. With our electric utility in North Carolina (Duke Energy), when you factor in taxes, fees, and everything we pay about $0.10 per kWh. Quick math shows you our panels save us about $53 each month. However, that’s 20 to 70 kWh less than we thought, and that translates to about $2 to $7 less per month that we are getting than we expected.

That said, we’re generating a lot of “free” and green electricity each month. As you would expect, our electricity varies widely with the seasons—higher in winter because of the furnace and summer because of air conditioning and lower in spring and fall. If you average everything out, we use 1,100 kWh each month, so those panels are addressing about half our usage. That actually seems pretty decent.

By the numbers

But you know me—words like “pretty good” and “decent” don’t cut it when we’re talking about real money and investments. Let’s dive into the nitty gritty to see how this works has an investment.

The whole set up cost $17,700, however our net cost was significantly less. For paying in cash we got a $1,100 discount. We also played credit card roulette, and that knocked our price down another $1,400. Finally, the biggest discount was the federal tax credit; solar panels allow for a 30% tax credit so that knocked another $5,700 off (we only got that when we filed out taxes the following year). Net all that out, and our panels cost $9,700.

For a $9,700 “investment” we got our electricity bill reduced by about $53 each month. If you do the math, that’s right at 4.0% return. If you’re curious, without the $1,400 credit card roulette the return would have dropped to 2.8%.

A 4% return isn’t very good. It’s a far cry from the 20%-ish annualized return the stock market has blessed us with these past two years, so that’s a bit of a miss. However, that’s not entirely fair to compare something like solar panels to the stock market.

Probably a better comparison would be a bond—we pretty regularly use electricity and those solar panels pretty consistently generate 530 kWh each month (the highest we get is in June at about 800 kWh and the lowest is in January at about 200 kWh). That 530 kWh is worth $53 each month, so that “feels” a lot more like a bond. Given the warranty on the solar panels is 25 years, I think it’s safe to assume we’ll continue to get that electricity generation for a really long time.

So we bought a $9,700 bond that pays us a monthly dividend of $53—a 4% return. That’s where I’ll give it a solid “decent”. In this market, 4% is a fairly decent return for a government or corporate bond: long-term Treasuries are yielding about 2-3% and investment grade corporate bonds maybe 4-5%. We’re right in that mix, so that’s okay I guess. Of course, I would have liked more (and thought we were going to get more), but that’s the way it is.

There is a bit of an ace in the hole that makes this a bit brighter. That 4% assumes that electricity rates stay at $0.10 per kWh, which is where they’ve been the past two years. Electricity rates have historically risen in the 2-3% range (although they didn’t this year specifically, I believe, because I invested in solar panels and the investing gods wanted to humble me). If you assume a 2% electricity rate inflation that return bumps up to 5.6%. That seems a little bit better.

As an aside, when I run for government office I am going to propose a nice little tax break financed solely by increasing electric rates. Between solar panels and LED lights, we can definitely reduce our electricity usage with minimal sacrifice. I cringe when I see incandescent light bulbs at someone’s house or in a store. A 5-watt LED bulb can generate the same brightness at a 60-watt incandescent bulb. Over the 20 life of an LED bulb, there is a electricity savings of about 1,000 kWh ($100). In case you’re curious, that’s a 251269% return (I’m not kidding, that’s a real number) on investment just changing your old bulbs to LED bulbs.

The intangibles

So as an investment I think the solar panels are a bit mixed. We’re getting 4% with the chance that it increases a bit. It’ll never be anything magical that rivals the stock market.

However, there is another piece that is important—the “green” perspective. In these two years, our solar panels have generated a total of about 12,000 kWh of pretty much pollution-free electricity. Given that Duke Energy still generates most of it’s electricity from coal plants, that has a positive carbon footprint.

Using back of the envelope math, that’s about 7 TONS of carbon dioxide that isn’t in the atmosphere. Basically, we’ve offset both of our cars, plus two of our neighbors’ cars. I don’t know how you personally value that, but that’s what you’d have to do to make the solar panels make sense in your head as a good investment.

The other day Foxy Lady and I were chatting about home improvements (she desperately wants a pool), and the solar panels came up. She asked me what I thought about the decision. I thought for a few seconds and said I regret doing it. The electricity generated was a bit short of what I had hoped, and the return was therefore below expectations.

I do think solar panels are the wave of the future. Right now, unless you are totally green, the federal tax incentives are a must for them to even be a consideration. You never know when they will end, and back in 2016 I think I had a bit of “get on the bus before it leaves” mentality that made me pull the trigger maybe sooner than I should have.

I know panel prices have gotten better (more kWh per panel) and prices have fallen, so I think if I was able to do it at current prices the return might be a bit better, but it’s still going to be in the 5-6% range.