Long before there were ever stocks or bonds, the original investment was gold. Heck, even before there was paper currency or even coins, gold was the original “money”.

That begs the question, What role should gold have in your portfolio? If you don’t want to read to the end, my quick answer is “None”. However, if you want to have a bit of a better answer, let’s dig in.

Gold as an investment

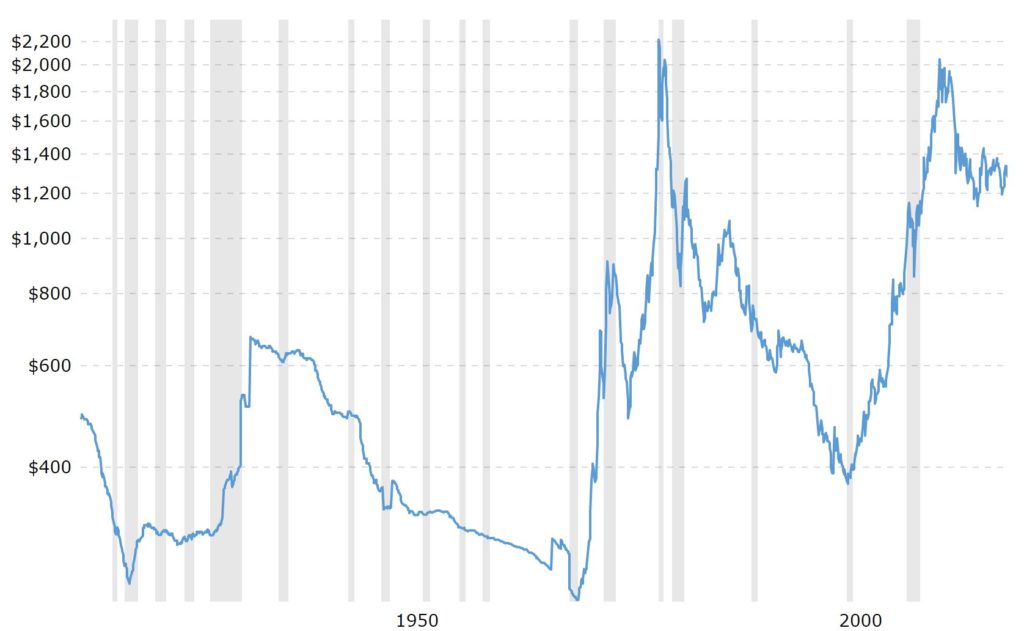

Just like stocks and bonds, gold is an investment. The idea is to buy it and have it increase in value. Makes sense. And historically, it seems to have been a good one—back in 1950 an ounce of gold was worth about $375 and today it’s worth about $1300. Not bad (or is it???).

However, there is a major difference between gold (and broadly commodities) as an investment compared to stocks and bonds. Gold is a store of value. If you buy gold it doesn’t “do” anything. It just sits in a vault collecting dust until you sell it to someone else.

That’s very different from stocks and bonds. When you buy a stock that money “does” something. It builds a factory that produces stuff or it buys a car that delivers goods or on and on. What ever it is, it’s creating something of value, making the pie bigger. That is a huge difference compared to gold, and it’s a huge advantage that stocks and bonds have over gold. You actually see that play out by looking at the long-term investment performance of gold versus stocks.

Golden diversification

Statistically speaking, gold gives an investor more diversification than probably any other asset. We all know that diversification is a good thing, so this means that gold is a great investment, right?

Well, not really. Stick with me on this one. Gold is negatively correlated with stocks (for you fellow statistics nerds, the correlation is about -0.12). Basically, that means when stocks go up gold tends to go down, and when stocks go down gold tends to go up.

Over the short term, that’s probably a pretty good thing, especially if you want to make sure that your investments don’t tank. In fact, that’s one of the reasons gold is sometimes called “portfolio insurance”. It helps protect the value of your portfolio if stocks start falling, since gold tends to go up when stocks go down.

However, over the long-term, that’s super counter-productive. We all know that over longer periods of time, stocks have a very strong upward trend. If gold is negatively correlated with stocks, and if over the long-term stocks nearly always go up, then that means that over the long-term gold nearly always goes (wait for it) . . . down.

That doesn’t seem right, but the data is solid. Look back to 1950: an ounce of gold cost $375. About 70 years later, in 2019, it’s about $1300. That’s an increase of about 250% which might seem pretty good, but over 70 years that’s actually pretty bad, about 1.8% per year.

Contrast that with stocks. Back in 1950 the S&P 500 started at 17, and today it’s at about 2900. That’s an increase of about 17,000%, or about 7.7% per year. WOW!!!

Just to add salt in the wound, inflation (it pains me to say since I think the data is suspect) was about 3.5% since 1950. Put all that together, and gold has actually lost purchasing power since 1950. Yikes!!!

A matter of faith

Fundamentally, if you have faith that the world will continue to operate with some sense of order, then gold isn’t a very good investment. So long as people accept those green pieces of paper you call dollars in exchange for goods and services and our laws continue to work, gold is just a shiny yellow metal.

However, if society unravels, then gold becomes the universal currency. The 1930s (Great Depression), the 1970s (OPEC shock), and 2008 (Great Recession) were all periods where gold experienced huge price increases. Those are also when the viability of the financial world order were in question. Each time, people were actively questioning if capitalism and banks and the general financial ecosystem worked.

People got all worked up and thought we were on the brink of oblivion. Gold became a “safe haven”. People knew no matter what happened, that shiny yellow metal would be worth something. They didn’t necessarily believe that about pieces of paper called dollars, euros, and yuans.

Yet, the world order hasn’t crumbled. Fiat currencies are still worth something. Laws still work, so that stock you own means that 1/1,000,000 of that factory and all it’s input belongs to you. Hence, gold remains just a shiny, yellow metal.

The bottom line is that stocks have been a great long-term investment, and gold hasn’t. And that’s directly tied to the world maintaining a sense of order. So long as you think that world order is durable and we’re not going to descend into anarchy Walking-Dead style, then gold isn’t going to be a good investment.

So the survey says: “Stay away from gold as an investment in your portfolio.”