I’m trying to build my audience, so if you like this post, please share it on social media using the buttons right above.

Sorry for the extended absence from writing the blog. Like many of you foxes and vixens, I have been homeschooling the kits, and that has kept me pretty busy (and on the brink of sanity). The boys started school last week (they go to school two days per week and do remote learning three days per week), so that gives me a little bit of time to get back into the swing of things with my blog.

Picking our way out of the rubble

2020 will obviously be remembered as the year of Covid. They year is not over yet, and we still have a presidential election. But I sure hope that nothing else this year can supplant Covid for the title of “Craziest Crap to Happen in 2020”. I’m a bit nervous.

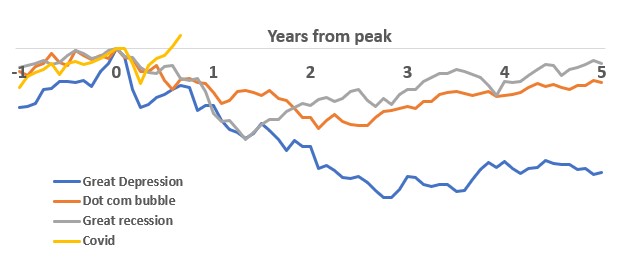

From a personal financial perspective, this was on the Mt Rushmore of stock market calamities, along with the Great Depression, the Internet Bubble, and the Great Recession. At the depth of the freefall in March, the Covid market was actually worse than the Dot-com burst and the Great Recession. And not just by a little bit: Covid was down 20% while Dot-com and the Great Recession where down 13% and 11% respectively at that same point in time.

However, a few months later everything is as good as it was before the nightmare started—actually better. Today, stocks are higher than they were before the Covid hit the fan.

You know how they say “a picture is worth a thousand words”? Here is a picture that shows those four stock markets. Crazy, huh?

We’ll remember this one for a while. In March, the speed and severity of the fall was matched only by the Great Depression. When you have to go all the way back to the Great Depression to find a similarly horrible market, you know you’re dealing with some serious stuff.

Yet, the recovery was arguably more extraordinary. Those other examples had a downward slide measured in years, not months. At it’s worst, the market lost over half it’s value. But what really puts the cherry on top for me is the time it took to recover. Those other markets took years (decades in the case of the Great Depression); Covid just took a couple months.

| After 3 months | Nadir | New high | |

| Great Depression | -34% | -83% after 3 years | 25 years |

| Dot-com bubble | -13% | -46% after 2 years | 12 years |

| Great Recession | -11% | -53% after 1 year | 5 years |

| Covid | -20% | -20% at 3 months | 7 months |

Covid market in perspective

I don’t think in March anyone would have predicted something like this. Personally, I thought we’d be at 3000 on the S&P 500 by July (about 10% down from the market highs). At the time, I thought I was crazy optimistic. As it turned out we were at about 3200, a new high.

That said, this one will leave a scar. No matter how optimistic one is, it will be impossible not to remember that hollow feeling investors had in their stomachs in March. If you were able to keep your head this turned out to be inconsequential. If you sold then you really did yourself a disservice with regard to wealth building.

I imagine that along with the Dot-com and Great Recession, the Covid market will be responsible for thousands of people not participating in the market. They say, “I remember Covid and I just don’t trust the market.” They’ll not invest and really hamper their ability to generate a large nestegg. I suppose we’ll see on all this stuff.

That said, I’m glad we’ve made it out the other end on this okay.