I started writing this blog because I wanted to share my own experiences with investing, including how to navigate the complex world of investing on your own. I am a firm believer in DIY financial management. That is what worked for me, and I believe all people can get really great results doing it on their own. That said, many readers ask about using a broker or investment adviser or financial planner. Here’s my take.

Quick disclosure: I am an investment adviser. I passed my Series 65 and work with a small number of friends, helping them with their finances.

Are financial professionals worth it?

As with any purchase you make, you need to evaluate a investment adviser on the basis of how much she costs, and how much value you get in return. On the surface I would say “no, it probably isn’t worth it,” however there are definitely some factors which may reverse that decision.

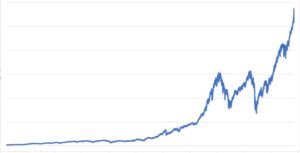

First, let’s look at how much investment advisers cost. The rates range widely. Plus there isn’t a lot of transparency in the marketplace so it’s not always easy to know what the going rate is. My experience says that 1-2% is typical. This can come in many forms—typically brokers get paid fees from the mutual funds they suggest for you or from the transaction costs for trades. Advisers tend to charge a percentage of your portfolio. We know that 1% coupons are really valuable, so those fees are a lot. Over an investing career they can add up to hundreds of thousands of dollars. That’s a pretty big deal.

Of course, if you’re getting a lot of value from your investment adviser, maybe it’s worth it. I just bought Metallica tickets today and they were expensive, but I’ll get a lot of value, so there you go. One of the main missions of this blog is to show you how you can invest successfully on your own, and I think most people can do that without having to hire a professional. Sure you have to make decisions on asset allocation, which accounts to use, what investments to make; but those aren’t really all that complex. Also, thanks to the efficient market lessons from A Random Walk Down Wall Street we know that you’re as good a stock picker as anyone.

So my general feeling is that investment professionals aren’t worth the money; a motivated investor can do just as well on their own and pocket the fees. Wait, what??? You said “motivated”. As it turns out, a lot of people, despite their best intentions, aren’t able to put their financial plan in motion. If you’re one of those people, and if an investment adviser can help motivate you to do the right things, then I do think they are more than worth it.

In this way, investment advisers are a lot like personal trainers. Most of us know that exercise is good for us, and most of us know how to run on the treadmill and lift weights properly (or you can find out by watching a 3-minute video on Youtube). But if a trainer can motivate you to actually hit the treadmill and the weights, they’re definitely worth the money, right? How much is your physical health worth to you? Same thing with finances. If you know what you should be doing, but for one of a million reasons you never end up actually doing it, maybe you should get an investment adviser to help you out.

Nearly every post I’ve done shows that there is a ton of value out there if you invest properly, taking into account things like time horizon, taxes, etc. But if you don’t do anything, you’re losing ALL that value. If an investment adviser helps you in ways you won’t or can’t, then you’ll probably end up ahead of the game, even after you take his fees into account.

How would you pick a financial professional?

So let’s say you’ve decided that an investment adviser makes sense for you. How do you pick a good one? This is one of the biggest challenges, and in my opinion one of the reasons a lot of people don’t get investment advisers: They don’t know a good one they can trust. The problem is there are a ton of them and the quality varies greatly. Sadly, there are a lot of unskilled people in the industry who don’t know what they’re doing. Even worse, there are some real shysters who might take your money, either overtly steal it or use other schemes to siphon away your money and put it in their pockets. It’s a legitimate concern.

First, you need to find someone you can trust. Ideally, this would come from a personal reference. Today you also have things like yelp.com or Angie’s List that gives ratings. Additionally, there are government agencies like FINRA.org that track these people so you can look them up to see how long they have been around and any complaints that have been files against them, etc. These are okay, but for my money, nothing beats a personal reference from someone you trust. Of course, it’s not always easy to have those conversations with friends: “So Mary, who is helping you with your money, and can I talk to them?”

Second, you need to find someone who is good. Of course, knowing this isn’t always easy. Using that same personal trainer analogy, you probably wouldn’t hire an obese trainer. You’d want someone who is ripped, someone who has shown they have been successful at physical fitness themselves (like my totally buff friends Christel and Tobias).

Similarly, you want a rich investment adviser. You want someone who has been successful creating wealth for themselves. But this is where the challenge comes in: if the investment adviser is wealthy then why is he working with you? Seriously. You have a lot of young kids who are doing this (let’s say less than 30). I’m sure there are some good ones, but I’m not trusting my family’s financial well-being to someone without a lot of experience. You also have a lot of people who just aren’t that good. If someone has been an investment adviser for 20 years or more and they aren’t a multi-millionaire, how good can he really be? I’m not trying to be mean, but shouldn’t that be more than enough time to accumulate some serious wealth?

Questions to ask:

If you do decide to go with a investment adviser, make sure you ask a lot, A LOT, of questions. Beyond your doctor or minister/rabbi, this person will probably have the biggest impact on your well being. Take the time to make sure you find a good one.

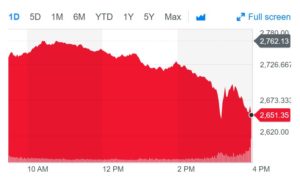

How long have you been doing this? This is an area where experience definitely matters. In particular, you want her to have lived through a few bear markets. At a minimum she should have been doing advising people since 2008 and even better if she’s been doing it since 2001.

What did you do during 2001 and 2008? Investing is a lot easier when things are going well. You prove your mettle during the tough times. Figure out how he handled himself when everyone thought the world was coming to an end.

What are you paid? This should be answered in excruciating detail. Does he get paid by you (how is the amount determined, when is it paid), by others like mutual fund companies (how much, how do you make sure you serve my interests ahead of theirs)?

What is your personal financial situation? No point sugar-coating it. Find what his financial situation is like. As mentioned above, if he isn’t rich, how good is he really? Also, the relationship you have with him needs to be based on trust because you’re going to be sharing everything with him. If he isn’t willing to reciprocate in some way, that might tell you something.

How will you ensure you serve my best interests? This is a biggie. Ideally you want her to have a fiduciary relationship which is a legal standard where she serves your interests ahead of anyone else’s, including her own. No matter how this turns out, you’re going to need to trust this person, and you should get a sense of how she will ensure that you are #1.

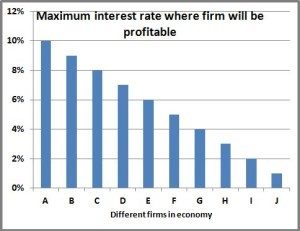

What is your investing strategy? Obviously, there are a lot of nuisances to this, especially as he customizes it to your specific situation. But he should definitely have an approach and a philosophy that he can articulate clearly and understandably.

What type of power will you have over my money? Will she be able to make trades and move money between accounts with your express permission, on her own, or not at all? This is a tricky one because maybe you want to offload these activities completely, so her having a ton of control may be okay. No matter, you should definitely understand this completely.

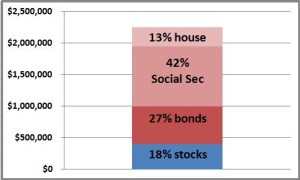

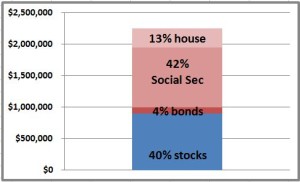

How will you take into account other assets that you won’t manage? Most situations will have him managing an account like your IRA or brokerage account but not others like your 401k, mortgage, pension, etc. Most times, he’s only paid on the accounts he manages, but to do his job well he’ll need to take into consideration those other accounts as well.

Those are what I came up with off the top of my head. At the end of the day, if you do go with an investment adviser make sure you find someone who has demonstrated they have the skills to build your wealth. Just as importantly, make sure you find someone who you can trust completely.