A few of you have written in asking what I think of Bitcoin and its crazy ride. Here are my Top 5 observations on Bitcoin.

5. Unprecedented wild ride

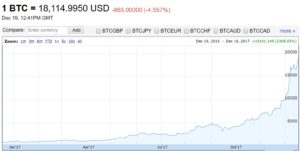

What has happened with Bitcoin in 2017 is really unprecedented. Its price has risen about 17x which obviously is a lot. To me, the more astounding point is that it has risen that high given it has a market cap of $300 billion (that is the total value if you added up all the bitcoins in the world).

If you think of bitcoin as a stock, that combination is pretty incredible. A lot of stocks have had crazy good years where they increased 17x. However, most of those are off a really low base: so maybe a $50 million company grew to a $1 billion company. Obviously, that is much easier to do off a smaller base.

However, with Bitcoin, continuing with that analogy, it grew from a $15 billion company (that’s about in the top 2000 globally) so that isn’t exactly small. Then it vaulted to $300 billion which would put it at about top 10. Think about that for a minute. Crazy.

4. I still don’t get it

I feel like some old man who doesn’t get the world around him. Damn kids won’t get off my lawn.

I couldn’t tell you with any specificity what Bitcoin is (there are buzzwords like “blockchain” but I don’t know what that means either). I certainly couldn’t tell you how I could “buy” them or “mine” them. I don’t know a single vendor who would accept Bitcoins, and if they did I wouldn’t know how you do that transaction.

And I think I tend to be fairly knowledgeable about these things. I can pay for stuff using my watch which proves I’m at the forefront of technology, but Bitcoin is just beyond me. I think that applies to most people—the story of Bitcoin is exciting but the details are pretty fuzzy.

3. Not surprising run-up

Given the incredible run-up, I am not surprised of it’s continued push higher in the past couple weeks, thanks to it’s listing on the Chicago Mercantile Exchange earlier in the month.

Being listed (or having your futures listed) on a very legitimate financial exchange obviously lends some credibility to something that up to this point had very little of it in respected financial circles. Also, it somewhat addresses #4. You can buy Bitcoin futures on the CME and I think many more people know how to do that than knew how to buy Bitcoins on their own two weeks before.

I still think Bitcoin is built on quicksand and will eventually collapse (more on this in a second), but in the short term it’s not surprising that it’s value has gotten a huge bump as it has been listed.

2. Ticking timebomb

There are a lot of people extremely bearish on Bitcoins, and many can give you a ton of reasons why it’s just an eyelash away from collapse. I predict that eventually a central bank will crush it like an elephant finally getting annoyed by a gnat.

What would provoke such action by the US Treasury? A terrorist attack. It seems likely that given Bitcoins anonymity features, it will be used to fund some type of terrorist attack that will kill innocent Americans. When that happens you can easily imagine the headlines, and then easily imagine the government’s response.

Bear in mind the whole premise of Bitcoin is that governments aren’t responsible stewards of their fiat currencies, so society needed some type of currency that the government can’t screw up. That’s a bit of a “Screw-you” to Washington, so I think if there’s any connection between Bitcoin and a terrorist attack, the government will come down HARD.

1. Go left when everyone else says “go right”

There’s a famous saying in investing that saying when everyone believes one thing, the opposite tends to happen. Right now, EVERYONE is saying that Bitcoin is a bubble and its value will crater. People have been saying that when it was at $1000 and then the chatter exploded when it crossed the $10,000 threshold. Now it’s at about $18,000.

Seriously, can you think of one serious, respected analyst who is bullish on Bitcoin? I can’t. Can you think of highly-regarded financial people who said Bitcoin is a crazy bubble that will crash HARD. I can think of about a thousand.

Given that, it makes me think that Bitcoin might still have some upside.

Who knows with all of this? I know I certainly don’t. Personally, we don’t invest our money in Bitcoin, mostly because of #4 and a bit because of #2. That said, I am enjoying the crazy ride that makes for fun reading in The Wall Street Journal.